Table of Contents

- Will a Recession Hurt My Real Estate Investment Property’s Value?

- Should You Worry About Property Values Dropping?

- Will Rising Interest Rates Hurt Real Estate Investing Profits?

- Should You Invest in Real Estate During a Period of High Inflation?

- Real Estate Investment in 2022 Will Be Profitable for Smart (and Patient) Investors

The housing market of the past decade has been one of the most lucrative investment opportunities available, and even more so in the past two years. As home values rise nationwide, investors are seeing huge returns in a short period of time.

But if you’re a smart investor, you know that no market stays hot forever. With rising interest rates, rapid inflation, and rumors of an upcoming recession, some potential investors have a few concerns about joining the real estate investment game right now. So is real estate really a good investment in 2023? If you want to know how to make money in real estate, the following information will prove useful.

Key Takeaways

- Low unemployment rates keep the price of rent from dropping.

- Property values historically rise in the long-term despite short-term market downturns.

- Interest rates are higher than they’ve been in years but remain below the 50-year average.

- Times of rapid inflation can benefit real estate investors.

- Ensure your real estate investment achieves maximum profitability by preparing for decreased liquidity, being meticulous in searching for the right investment property, and having patience if there is a market downturn.

Will a Recession Hurt My Real Estate Investment Property’s Value?

The U.S. economy declined for the first two quarters of 2022. Two consecutive quarters of decline is often considered a recession. So is it time to worry about whether your real estate investment will suffer? While a recession could influence your property’s value, if you take steps to mitigate risk, you can keep your investments profitable in the upcoming months, years, and decades. Don’t always let a potential recession dissuade you if you see a tantalizing investment property for sale. There are other factors to consider.

Low Unemployment Keeps the Price of Rent Stable

Despite a cooling economy, at 3.6%, the U.S. unemployment rate is hovering around historic lows. The unemployment rate between 1948 and 2022 averaged 5.75%. Economists at Trading Economics forecast the unemployment rate to remain at 3.6% or lower in the upcoming year.

With millions of unfilled jobs throughout the country, many renters have solid job security and alternative job options. They could turn to these options in the event of an unexpected job loss, making rental properties a potentially good part of your portfolio.

Low unemployment rates are good news for landlords. Renters with high job security keep demand for rental units high, which keeps the price of rent from dropping to unprofitable levels. Additionally, they are less likely to miss payments or be forced to move to other markets.

Prepare for Possible Decreased Liquidity

While a recession in 2022 or the following year is unlikely to tank the value of your investment property, it may come with short-term decreases in value. If you rely on liquidity in your investments, prepare for the possibility of being unable to sell for a time.

Make sure you have some cash savings to get you through any economic difficulty without selling your property. If you can hold onto your rental properties through periods of recession, you’ll quickly see your property’s value return and surpass its original value.

Protect Yourself by Calculating the Cap Rate

Over the past few years, some real estate investors purchased properties with low cash flow or even no cash flow at all. With rapidly rising housing costs, these investors were able to count on their properties to become more profitable within a few years.

When you can’t expect liquidity from your investment, minimize risk by buying properties that are sure to bring in a positive cash flow and have a strong ROI. You can evaluate whether a property has a good ROI by finding the cap rate.

To find your cap rate you’ll need to know your net operating income, or NOI. Find NOI by calculating total yearly income and subtracting total yearly expenses.

For example, if a property brings in $2,000 per month, yearly income is $24,000. If mortgage payments, insurance, repairs, and other expenses add up to $14,000 per year, your NOI is $24,000 – $14,000 = $10,000.

Then, divide the NOI by the current value of the property. If the property’s value is $200,000 with an NOI of $10,000, your cap rate will be $10,000 / $200,000 = .05 or 5%.

A higher cap rate means your property will be more profitable. However, a very high cap rate can sometimes signal a risky investment. Aim for a cap rate between 5% and 10% for a low-risk, high-profit investment.

Important

Calculate net operating income by taking total yearly income and subtracting total yearly expenses.

Should You Worry About Property Values Dropping?

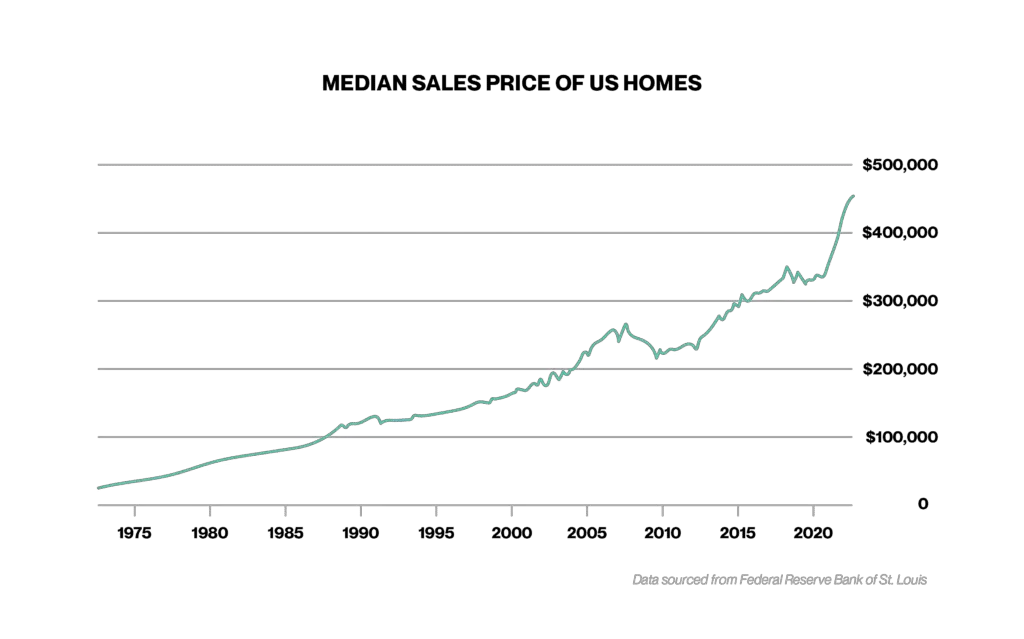

At $440,300, the current median sales price of U.S. homes is 15.08% higher than last year. 2021 saw a similarly rapid increase in sales prices, with an 18.6% increase from 2020.

While rising interest rates and an inflationary economy have slowed price growth in recent months, the real estate market is heavily influenced by the law of supply and demand. This law states that prices will rise when there is greater demand than supply. Real estate investment trusts are affected by this law as well.

Undersupply and Low Vacancy

During the Great Recession in 2007–09, vacancy rates skyrocketed, and home values plummeted. In 2009, the national rental property vacancy rate hit an all-time high of 11.1%. Since then, vacancy rates have steadily declined to reach 5.8%.

The market slowdown has occurred alongside a jump in the supply of homes for sale. However, the supply of homes is still 54% lower than was available in 2017–2019.

President of Black Knight Data & Analytics, Ben Graboske, reports, “With a national shortage of more than 700,000 listings, it would take more than a year of such record increases for inventory levels to fully normalize.”

While construction of new units quickened over the last few years, it remains lower than needed to meet the demand, putting the U.S. in a severe housing shortage. That’s something to keep in mind when looking at ways to invest in real estate.

A report released in July 2022 by the housing research group, Up For Growth, reported the U.S. has a housing shortage of 3.9 million units. The group reports that just 25.6% of metro areas are either producing enough housing supply or are on track to recover from the underproduction of homes over the last few years.

Price Appreciation Will Continue (Slowly)

Despite the housing shortage, some people are sounding the alarm that the housing market is in trouble because the price appreciation has slowed quite suddenly. In June 2022, the annual appreciation rate fell from 19.3% to 17.3%.

While this is a significant slowdown, a 17.3% appreciation rate is still far above average. The market would have to continue to slow for the next six months to return to average levels of growth. It would then have to slow beyond that to reach a point where investors saw losses in their property values, thus hurting real estate investment.

Experts are divided on how quickly prices will continue rising in the coming year. But, most agree that we will not see home values drop. In a survey of seven different housing authorities, the average prediction for price appreciation in the coming year was 6.1%. Goldman Sachs predicted a low-end growth rate of 2.7%, while Zillow had the most optimistic forecast with a 14.9% appreciation.

You Can Always Count on Rising Home Values (if You Think Long-Term)

With the Great Recession still fresh in many people’s minds, it can feel like real estate investing is a risky business. During the Great Recession, property values fell 33% and took years to recover. However, once prices recovered, they continued rising and rising, providing a boom for investment realty. An investor who purchased a property in 2007 for their portfolio, just before the housing crash, would have recovered the value of their property and much more if they held onto their investment for ten years or longer.

This is one of the safer ways to invest in real estate. Real estate is a long-term game. Risk can be brought to near zero if you hang onto your investment properties for multiple decades. The following chart shows home value appreciation in the U.S. for the last 50 years. As you can see, even the unprecedented housing crash that caused the Great Recession would not have done long-term damage to a real estate investor who was playing the long game and willing to wait out the temporary value decreases. By staying with the real estate investment trusts in their portfolio, investors see the values rise.

Tip: Choose Your Market Carefully to Avoid Short-Term Value Depreciation

If you’re hoping to avoid the short-term value depreciation that comes with market downturns, invest in housing markets that are expected to stay strong. Housing markets in areas with good job opportunities and expected population growth tend to perform better even when the national markets struggle. Regions with top universities or large medical centers reliably create job opportunities and well-performing housing markets.

A report from Pew Research found a decreasing number of people prefer living in urban environments. Housing prices in urban areas like San Francisco and New York are still much higher than in other areas of the country. But as more people shift away from city-living, these places have seen decreased demand. For the safest investment, avoid areas that have experienced declining interest in recent years. You’ll also want to take a look at the hottest real estate markets out there.

Important

Real estate is all about the big picture rather than short-term gains or losses. Historically, real estate property values rise over time. Don’t let a temporary dip cause unnecessary concern or fear.

Will Rising Interest Rates Hurt Real Estate Investing Profits?

Over the past few years, investors enjoyed the advantages of historically low-interest rates. However, the Federal Reserve has raised interest rates multiple times in 2022. The 0.75 interest rate hike in June 2022 was the largest since 1994. According to Freddie Mac, the current average interest rate for a 30-year mortgage is 5.3%, which is 2.5 percentage points higher than the average interest rate at this time last year. Do higher interest rates mean you should reconsider real estate investing?

While real estate investors in 2022 won’t enjoy the profits driven by low-interest rates of the past few years, rates remain lower than the average of the past 50 years. Many savvy real estate investors of the last half century have seen high ROIs despite high-interest rates. If you want to get into real estate investing, don’t let high-interest rates deter you.

Though you can still turn an excellent profit on an investment with a high-interest rate, your budget will likely have to shrink to accommodate the extra interest payments. While it may take more time to find properties that fit your budget, you want to make sure you bring in high enough rents to cover your costs. Also take into consideration the costs of investors property management. Be meticulous in searching for the right property to ensure your investment remains profitable despite high-interest rates.

Tip: Avoid ARMs to Stay Profitable

An adjustable-rate mortgage is a loan that has a changing interest rate. While you may be able to initially get a lower interest rate with an adjustable-rate mortgage, these loans come with a huge amount of uncertainty. In times of inflation and recession, interest rates can change quickly. To keep the cost of your investment low, stick with a fixed-rate mortgage.

Should You Invest in Real Estate During a Period of High Inflation?

The U.S. hasn’t experienced this high of inflation rates since 1981. With inflation reaching 9.1% in June 2022, some investors wonder how this will impact their investment.

The good news is that inflation tends to benefit, rather than harm, the value of your real estate investment. During inflationary periods, the price of rent increases as wages increase. But your mortgage payments remain the same. That’s important to remember as you invest in real estate.

For example, if you bought your property in 2021 and have a monthly payment of $1,200, your payment will not increase. However, between 2021 and 2022, the price of rent rose 3.8%. If you were formerly earning $1,500 in rent, you would now be earning $1,557. While the yearly increase may seem small, over 30 years, that rent appreciation adds up. These increases can have an effect on apartment investment.

Important

In general, high inflation rates tend to benefit real estate investment values for rental properties.

Real Estate Investment in 2022 Will Be Profitable for Smart (and Patient) Investors

Real estate is not the get-rich-quick scheme that some investors may hope for, but it is still a reliable investment. Despite rumors of a downturn in the housing market, if you know what you’re doing, you can begin building wealth in real estate this year. Real estate finance benefits don’t have to be out of reach, but keep the following things in mind.

- Think long-term: Be prepared to hold onto your property for years, ideally decades.

- Choose your investments wisely: Invest in markets with rising populations and wait for the right property that can produce a strong cash flow. If rent costs appear volatile, you can always invest in land.

- Don’t let interest rates deter you: Investors have been using real estate to build wealth for decades. They didn’t let high-interest rates stop them. But remember to stick with fixed-rate mortgages.

- Let inflation work for you: Putting your money in real estate will protect you during high inflationary periods.

To learn how to start investing in real estate, check out these articles:

What to Know When Buying Your First Investment Property

Leaders Media has established sourcing guidelines and relies on relevant, and credible sources for the data, facts, and expert insights and analysis we reference. You can learn more about our mission, ethics, and how we cite sources in our editorial policy.

- Black Knight, Inc. (2022, August 1). Black Knight: June Sees Record-Setting Slowdown in Home Price Growth, Largest Monthly Inventory Gain in 12 Years; Prices Back Off Highs in Some Major Markets. PRNewswire. https://www.prnewswire.com/news-releases/black-knight-june-sees-record-setting-slowdown-in-home-price-growth-largest-monthly-inventory-gain-in-12-years-prices-back-off-highs-in-some-major-markets-301596377.html

- Casselman, B. (2022, July 28). U.S. Economy Shows Another Decline, Fanning Recession Fears. The New York Times. https://www.nytimes.com/2022/07/28/business/economy/gdp-q2-economy.html

- Dunaway-Seale, J. (2023, February 8). U.S. Rent Prices Are Rising 4x Faster Than Income (2022 Data). Real Estate Witch. https://www.realestatewitch.com/rent-to-income-ratio-2022/

- Evaluating the Housing Market Since the Great Recession. CoreLogic. https://www.corelogic.com/wp-content/uploads/sites/4/2021/06/report-special-report-evaluating-the-housing-market-since-the-great-recession.pdf

- Horsley, S. (2022, July 13). Inflation hit 9.1% in June. NPR. https://www.npr.org/2022/07/13/1111388330/inflation-hit-9-1-in-june

- Median Sales Price of Houses Sold for the United States. (2023, April 25). https://fred.stlouisfed.org/series/MSPUS

- Mortgage Rates. (n.d.). Freddie Mac. https://www.freddiemac.com/pmms

- Olick, D. (2022, August 1). Home prices cooled at a record pace in June, according to housing data firm. CNBC. https://www.cnbc.com/2022/08/01/home-prices-cooled-at-record-pace-in-june-according-to-housing-data-firm.html

- Parker, K., Horowitz, J. M., Minkin, R., & Mitchell, T. (2022, February 1). Americans Are Less Likely Than Before COVID-19 To Want To Live in Cities, More Likely To Prefer Suburbs. Pew Research Center’s Social & Demographic Trends Project. https://www.pewresearch.org/social-trends/2021/12/16/americans-are-less-likely-than-before-covid-19-to-want-to-live-in-cities-more-likely-to-prefer-suburbs/

- Rental Vacancy Rate in the United States. (2023, May 3). https://fred.stlouisfed.org/series/RRVRUSQ156N

- Team, H. (n.d.). Will Home Prices Drop in 2022? Forecasts from 7 Housing Authorities | Homeownership Hub. https://home.com/housing-market-forecast-from-housing-authorities/

- TRADING ECONOMICS. (n.d.). United States Unemployment Rate – April 2023 Data – 1948-2022 Historical. https://tradingeconomics.com/united-states/unemployment-rate

- US Unemployment Forecast 2021-2026 | Data and Charts. (2023, April 14). Knoema. https://knoema.com/infographics/ennihcf/us-unemployment-forecast-2021-2026-data-and-charts