A good real estate investor knows the market makes all the difference. As renter preferences shift and rental properties become increasingly expensive, choosing the right market is essential.

So how do you pick the right market for your real estate venture? After analysis of the key metrics, the data uncovered the hottest housing markets of this year.

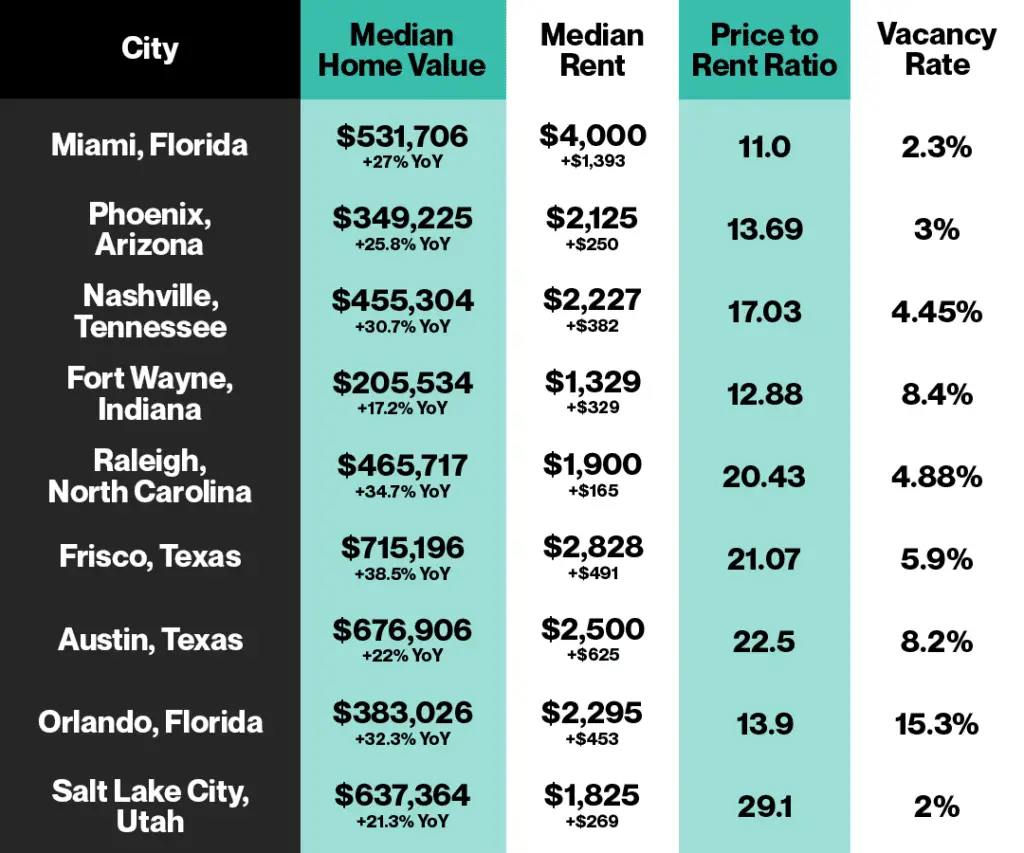

10 of the Hottest Real Estate Markets in 2023

1. Miami, Florida

- YOY Increase in Home Value: 27.2%

- Median Home Value: $531,706

- Median Monthly Rent 2021 to 2022: $1,393 to $4,000

- Price-to-Rent Ratio: 11.0

The 2-bedroom, 1-bathroom Miami home shown above is currently listed for $520,000, a 137% increase in value since 2015. It represents the type of appreciation that many investors in the area have seen over the past few years, showing why Miami is at the top of our list for the hottest housing markets.

Miami real estate agent Jamey Prezzi explains why the Miami real estate market is hot and why it’s expected to stay strong. She says on her Youtube channel, The Prezzis Miami, “There’s no personal income tax in Florida. There’s no estate or inheritance tax. And in comparison to other states, the property tax is relatively low or very similar. And it is a very favorable state for retirees.”

While a price-to-rent ratio as low as 11.0 could indicate a low demand for rentals in a market, this is not the case in Miami. Renters make up over half the population in Miami, largely due to the tourism-based economy that brings in numerous seasonal residents and workers. The low vacancy rate is further evidence of Miami’s high demand for rentals. At 2.3%, Miami’s vacancy rate is one of the lowest in the country.

The population of Miami is on the rise. Forecasts predict 300,000 people will be added to the area by 2025. With a growing population, low vacancy rates, and a low price-to-rent ratio, investors entering this market can count on a reliable return on investment, making this the top market for real estate investors in 2022.

2. Phoenix, Arizona

- YOY Increase in Home Value: 25.8%

- Median Home Value: $343,225

- Median Monthly Rent 2021 to 2022: $1,875 to $2,125

- Price-to-Rent Ratio: 13.69

This 3-bedroom, 3-bathroom Phoenix home is listed near the area’s median home value at $350,000. The last time this home sold was in 2020 for $215,000. In just two years of appreciation, the home has risen in value by 60%, showing how quickly home prices are rising.

In her Youtube channel, Living in Arizona, real estate agent Samantha Sloan explains why the Phoenix real estate market has taken off in recent years. “We have been continuing to grow really quickly, not just with people coming in and migration, but also with the amount of businesses here, and that has really boosted the economy. There’s an incredible amount of job and earning opportunities here in Phoenix,” she says.

Forecasts predict the population will grow 1.3% each year over the next five years, allowing investors to feel confident in the region’s prospects. A vacancy rate of 3% shows the market is not only profitable, but rentals are also in high demand.

3. Nashville, Tennessee

- YOY Increase in Home Value: 30.7%

- Median Home Value: $455,304

- Median Monthly Rent 2021 to 2022: $1,845 to $2,125

- Price-to-Rent Ratio: 17.03

This 3-bedroom, 2-bathroom Nashville property is listed for $450,000 in 2022. When the home last sold in 2017, the price was $155,000, representing a price increase of 190% over just five years.

Nicholas Gerli, CEO of real estate investment consulting firm Reventure Consulting, says, “Nashville has managed to show really good growth over the last decade. Its percentage appreciation is around +70% over the last ten years. And that’s really strong. That’s well above average.”

With a 4.45% vacancy rate, investors will see both a reliable demand for rentals and steady profits. Forecasts predict Nashville will experience population growth of 1.3% each year for the next five years, ensuring demand for rentals will stay high.

4. Fort Wayne, Indiana

- YOY Increase in Home Value: 17.2%

- Median Home Value: $205,534

- Median Monthly Rent 2021 to 2022: $1,000 to $1329

- Price-to-Rent Ratio: 12.9

With a list price of $204,900, this 3-bedroom, 2-bathroom Fort Wayne property has appreciated 98.5% since 2015, representing the steady growth the area has seen in recent years. The price also represents reasonable mortgage rates.

Indiana real estate agent Knowe Dials believes Fort Wayne is one of the few affordable markets left for cash-strapped investors. He explains on his YouTube channel, Living in Fort Wayne, “People need to know that they can find turnkey properties that meet the 1% rule or more.”

The 1% rule states that gross monthly rents should be equal to 1% of the purchase price. Investors used this rule for years to determine the profitability of a potential investment property. But as real estate prices went up, investors in nearly every market had to abandon this rule and accept the risk of less profitable investments. Fort Wayne is one of the few housing markets left that still has properties that meet this rule.

While some midwest housing markets struggle with stagnant home values, Fort Wayne has seen steady growth. The low median home values also make this an easier market to start out in as an investor who doesn’t have large amounts of cash. An 8.4% vacancy rate shows demand for rental properties will be moderate.

5. Raleigh, North Carolina

- YOY Increase in Home Value: 34.7%

- Median Home Value: $465,717

- Median Monthly Rent 2021 to 2022: $1,735 to $1,900

- Price-to-Rent Ratio: 20.43

This 3-bedroom, 3-bathroom Raleigh property, listed at $469,000, has increased 96.4% increase in value from 2015, highlighting the type of appreciation investors can expect to see in the Raleigh real estate market.

On her YouTube channel Living in Raleigh, North Carolina, real estate agent Linda Nuxoll advises buyers to purchase real estate sooner rather than later. “Our prices have stabilized. They’re not gonna go down anytime soon. Raleigh is a really desirable place to live. We’ve got Meta coming in. We’ve got Google, Apple, and Amazon. We’ve got everyone coming here. It’s going to forever be a desirable place to live,” she says.

At 4.88%, the vacancy rate also shows the demand for rentals in the area is strong. This demand will likely stay high over the next two decades, as Raleigh is projected to be the third fastest-growing metro area through 2040.

6. Frisco, Texas

- YOY Home Value Increase: 38.5%

- Median Home Value: $715,196

- Median Monthly Rent 2021 to 2022: $2,337 to $2,828

- Price-to-Rent Ratio: 21.07

This 5-bedroom, 3-bathroom Frisco home is listed near Frisco’s median value at $715,000. This is a 99% increase in value since 2015. Investors in Frisco can expect similar returns on their properties, making Frisco a high-return housing market.

Texas real estate agent Shanza Khan explains how numerous job opportunities have attracted new residents to Frisco. “Frisco’s economy is booming. It has attracted several companies like Walgreens, Home Depot, T-Mobile, Oracle, Moneygram and so many more companies that are making Frisco their home . . . Frisco’s economy is one of the strongest in North Texas,” she describes in a video on her YouTube channel, Life in Dallas, Texas.

Frisco has grown in size by 71% in the last decade. The vacancy rate of 5.9% makes Frisco a reliable market for investors.

7. Austin, Texas

- YOY increase in Home Value: 22%

- Median Home Value: $676,906

- Median Monthly Rent Change from 2021 to 2022: $1,875 to $2,500

- Price-to-Rent Ratio: 22.5

This 5-bedroom, 3-bathroom Austin home is listed at $675,000, just below the region’s median home price. With a 121% increase in value since 2015, the property highlights how much value the Austin housing market has created for investors in the last few years.

In “Why Everyone Is STILL Moving to Austin Texas,” Frank De Ovando, a real estate agent in the city, explains, “Austin, Texas, is the hub for growth in the country right now . . . You’ve got Google here. You’ve got Facebook here. You’ve got Tesla here. You’ve got Samsung . . . All of these big companies, primarily tech companies are coming to Austin, Texas, from the San Francisco Bay area, creating what is no longer old-college-town, Austin, Texas. This is now becoming the San Francisco of the state of Texas.”

While the vacancy rate is on the high end at 8.2%, the population is expected to grow 2% each year, ensuring Austin will remain one of the hottest markets in the U.S. for years to come. In fact, by 2040, Austin’s population is expected to double.

8. Orlando, Florida

- YOY increase in Home Value: 32.3%

- Median Home Value: $383,026

- Median Monthly Rent Change from 2021 to 2022: $1,842 to $2,295

- Price-to-Rent Ratio: 13.9

This 3-bedroom, 2-bathroom home in Orlando is listed near the median price in the area at $383,000. Since 2015, the home has appreciated by 172%, which is on par with the appreciation investors have seen in their properties throughout the Orlando area in the past seven years.

Florida real estate broker Jobe Peterson explains how population growth, rent increases, migration changes, and a strong economic landscape put Orlando on the list of the hottest real estate markets. In a video on why it’s a good idea to buy a house in this city, Peterson says, “The future of Orlando’s economic landscape is looking positive. Orlando has the framework for excelling and expanding industries that are outpacing the nation.”

Orlando’s vacancy rate of 15.3% is on the high end. While investors may need to compete for the best tenants in the area, any property that stands out above the rest will have high profitability.

9. Salt Lake City, Utah

- YOY Home Value Increase: 21.3%

- Median Home Value: $637,364

- Median Monthly Rent 2021 to 2022: $1,556 to $1,825

- Price-to-Rent Ratio: 29.1

This 4-bedroom, 3-bathroom Salt Lake City home, listed in 2022 for $629,000, has seen an astounding 242% appreciation since 2015 when it was valued at $184,000. This type of appreciation is common for Salt Lake City properties, showing why this city makes the list of hottest markets for real estate.

Utah-based realtor Brandon Hansen says people are moving to Utah because of the strong economy. “We’ve got a really low unemployment rate. It’s a great place to start a business or find a job,” Hansen says in “Why Are So Many People Moving From California to Utah?“

Low unemployment rates, strong job growth, and low property taxes make the Salt Lake area the perfect location for investors. The rental vacancy rate in Salt Lake County has remained below 4% for 10 consecutive years, dropping below 2% in 2021.

10. Columbus, Ohio

- YOY Home Value Increase: 16.6%

- Median Home Value: $243,967

- Median Monthly Rent 2021 to 2022: $1,300 to $1,499

- Price-to-Rent Ratio: 13.56

This 3-bedroom, 2-bathroom Columbus property, listed at $243,900, has experienced significant appreciation since 2015 when it was valued at $134,800. This shows a 79.3% growth in value over the past seven years.

Real estate investor Tyler Bossetti explains why Columbus is a hot housing market: “Our population is set to double in size and there are major companies making announcements every single day to bring jobs here or to bring another headquarters here.”

The low cost of living in the midwest, along with the expanding economy, has attracted new residents to Columbus from the more expensive coasts. With a vacancy rate of 4.72%, Columbus has a healthy supply of renters.

Looking Forward to the Hottest Real Estate Markets of 2023

While this list includes the housing markets that are already hot, investing in a market that is on the verge of heating up provides more opportunities to make a major profit.

With remote work becoming the status quo, smaller, suburban, and rural housing markets are on the upswing. Because housing affordability is at an all-time low, expect growth in areas with lower living costs.

The list of the five hottest real estate markets in 2023 consists of regions with affordable housing and plenty of things to do. These are ideal places to scope out for investors looking to get ahead of the curve before the market gets too hot. Realtor.com reports each of these regions is receiving increasing attention online, and the properties in each region are beginning to sell more quickly.

Better yet, each of these markets has a median home value of $370,000 or less with reasonable mortgage rates. This means you can enter the market with less cash, and there is plenty of room for home prices to continue rising. Listed below are markets that have seen rents go up in the past year and home prices appreciate by 13% or more.

- Rochester, New York

- Springfield, Massachusetts

- La Crosse, Wisconsin

- Topeka, Kansas

- Bangor, Maine

If you’re ready to enter one of these housing markets and start your real estate investing journey, check out this article to learn everything you need to know about buying your first rental property.

If you’re uncertain whether now is the right time to start real estate investing, check out our guide to the risk and benefits of investing here: Is Real Estate a Good Investment

Leaders Media has established sourcing guidelines and relies on relevant, and credible sources for the data, facts, and expert insights and analysis we reference. You can learn more about our mission, ethics, and how we cite sources in our editorial policy.

- 2022, Homeownership and vacancy rates by state: Indiana | FRED | St. Louis Fed. (n.d.). https://fred.stlouisfed.org/release/tables?eid=258510&rid=144

- Article – Real estate Center. (n.d.). https://www.recenter.tamu.edu/articles/research-article/TexasQuarterlyApartmentReport-2242

- Florida, Richard and Pedigo, Steven. “Miami’s Housing Affordability Crisis.” https://carta.fiu.edu/mufi/wp-content/uploads/sites/32/2019/03/Miamis_Housing_Affordability_Crisis_FNL.pdf

- Forecast Population – The Beacon Council. (2020, June 12). The Beacon Council. https://www.beaconcouncil.com/data/demographic-overview/forecast-population/

- FriscO, TX Housing Market Trends | Guaranteed rate. (n.d.). https://www.rate.com/research/frisco-tx#:~:text=As%20previously%20noted%2C%20the%20population,a%20total%20of%2054%2C962%20units.

- Gruca, Terri. “In 20 years, Austin’s population will be 4.5M. Here’s what Austin will look like.” KVUE. https://www.kvue.com/article/money/economy/boomtown-2040/austin-news-growth-what-will-it-look-like-in-2040/269-08d351eb-0e6b-4229-9e77-4f1a6ced5260

- Hottest markets Archives. (n.d.). Realtor.com Economic Research. https://www.realtor.com/research/topics/hottest-markets/

- Huisache, S. M. (2022). The most vacant cities in America: 2022 data. Anytime Estimate. https://anytimeestimate.com/research/most-vacant-cities-2022/?utm_source=social&utm_medium=twitter&utm_campaign=vacant

- LIFE IN DALLAS TEXAS. (2022, January 10). Frisco, Tx PROS & CONS | Things To Know Before Moving In 2022 [Video]. YouTube. https://www.youtube.com/watch?v=nZkwJBQflBc

- Linda Nuxoll, Realtor – Raleigh Durham Chapel Hill. (2022, June 11). SHOULD YOU BUY A HOUSE NOW OR WAIT? [Video]. YouTube. https://www.youtube.com/watch?v=tgUEONpFJ6g

- LIVING IN ARIZONA. (2022, June 30). Should I wait to buy a house in Phoenix Arizona? | Moving to Phoenix Arizona | Phoenix Real Estate [Video]. YouTube. https://www.youtube.com/watch?v=Q7d4nZEIKvI

- LIVING IN AUSTIN TEXAS. (2022, May 6). Why Everyone is STILL Moving to Austin Texas | 2022 [Video]. YouTube. https://www.youtube.com/watch?v=mvuJThO8MfQ

- Living In Fort Wayne. (2022, April 16). Pros and cons of investing in Fort Wayne, Indiana [Video]. YouTube. https://www.youtube.com/watch?v=7Ufh06HHeA4

- Living in Utah County. (2022, May 13). Why Are So Many People Moving From California To Utah?? [Video]. YouTube. https://www.youtube.com/watch?v=mJCIU-2mIeg

- Middle Tennessee market Survey 2nd quarter 2022 press release – GNAA – Greater Nashville Apartment Association. (n.d.). https://www.gnaa.org/news/middle-tennessee-market-survey-2nd-quarter-2022-press-release—gnaa

- Parker, J., & Parker, J. (2022). Triangle’s apartment crunch worsens – vacancy down, and price of rent jumps 20% | WRAL TechWire. WRAL TechWire. https://wraltechwire.com/2022/06/10/apartment-crunch-worsens-vacancy-down-and-price-of-rent-jumps-20-percent-in-wake-county/

- PricewaterhouseCoopers. (n.d.). Emerging trends in real Estate 2023. PwC. https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/real-estate/emerging-trends-in-real-estate.html

- Residential rent statistics for Columbus Ohio | Department of Numbers. (n.d.). https://www.deptofnumbers.com/rent/ohio/columbus/#:~:text=The%20rental%20vacancy%20rate%20is,according%20to%20Census%20ACS%20data.

- Reventure Consulting. (2020, December 29). Nashville Real Estate: The best places to buy! [Video]. YouTube. https://www.youtube.com/watch?v=LfkfzwjmaE0

- South Florida’s 2022 multifamily vacancies predicted to be among lowest in the country | Daily Business Review. (2022, January 25). Daily Business Review. https://www.law.com/dailybusinessreview/2022/01/24/south-floridas-2022-multifamily-vacancies-predicted-to-be-among-lowest-in-the-country/?slreturn=20220704150731#:~:text=By%20the%20end%20of%202022,lowest%20levels%20in%20the%20country.

- Stacker, & Staff, A. (2022, June 10). 3 out of 10 U.S. cities where rents have increased the most are in Arizona. https://www.azfamily.com. https://www.azfamily.com/2022/06/10/3-out-10-us-cities-where-rents-have-increased-most-are-arizona/#:~:text=This%20is%20evident%20in%20Phoenix’s,rental%20property%20in%20the%20area.

- The Listing Real Estate Management. (2021, July 14). Why Buy A Rental Property in Orlando? | Orlando vs. Other Florida Real Estate Markets [Video]. YouTube. https://www.youtube.com/watch?v=Jqj-6qTBDrU

- The Prezzis Miami & Miami Beach Real Estate. (2022, April 25). Why the Miami Real Estate Market Is Still Hot & Why It’s Predicted To Remain Strong [Video]. YouTube. https://www.youtube.com/watch?v=jRdnFhrIfPk

- Tyler Bossetti. (2021, July 6). The Best Market To Invest In Real Estate (Columbus, Ohio) [Video]. YouTube. https://www.youtube.com/watch?v=Smyh6cal9HY

- Wood, James A. “Salt Lake County’s Historic Apartment Boom: Past, Present, and Future.” Kem C. Gardner Policy Institute | University of Utah. https://gardner.utah.edu/wp-content/uploads/AptMrkt-Zions-Mar2022.pdf