Melanie Bajrovic’s love for the bar and restaurant industry began forming at the age of 12 while working in her parents’ restaurant. 15 years later, she’d have the financial stability to pursue her passion and open her own bar. Her early start in real estate investing allowed her to pursue her dream and increase her financial success.

When Bajrovic bought her first rental property at the age of 22, she didn’t have any long-term goals for growing her wealth. She simply wanted to create a safety net for herself in case she ever lost her job or needed extra cash in an emergency.

The passive income from her investment provided more than just a safety net—her rental property became instrumental during her journey to financial freedom. With the equity from her first investment, Bajrovik was able to purchase a commercial property and use the space to open her bar and restaurant, Monty’s Gastropub.

Bajrovik continued to expand her real estate investments. Now, at 32-years-old, she owns five single-family homes and two commercial properties, making her real estate investment business worth over a million dollars. Her wealth continues to grow through her investments, and she gets to keep working her dream job.

Countless investors like Bajrovic find that real estate is a reliable avenue for creating sustainable wealth that opens doors to a more financially free life. Before starting your real estate investment journey, it’s important to know why this wealth-building strategy works for so many people.

Important Takeaways

- Real estate investing has historically been less volatile than stock market investing, and brings reliable returns to investors.

- The ability to leverage real estate investments makes it possible to grow wealth with less upfront cash than other investing options.

- Rental properties act as a hedge against inflation.

- Investors can use expenses from rental properties to lower taxable income.

- The passive income generated from real estate enables many investors to supplement their regular salary or eventually stop working altogether.

Top 5 Reasons to Invest in Real Estate

1. Achieve Reliable Returns With Less Volatility Than the Stock Market

One of the most common questions new investors ask is whether to invest in real estate or the stock market. Between 1891 and 2020, the average home price appreciation was just 3.2% per year, only slightly higher than the average inflation rate. The S&P 500, on the other hand, had had an average annual return of 10.5% since the 1950s, when it was first created in its modern form.

Because of these return rates, investors who held on to stocks for the long term had better returns than investors who held onto real estate. But stock market investors saw considerably more volatility.

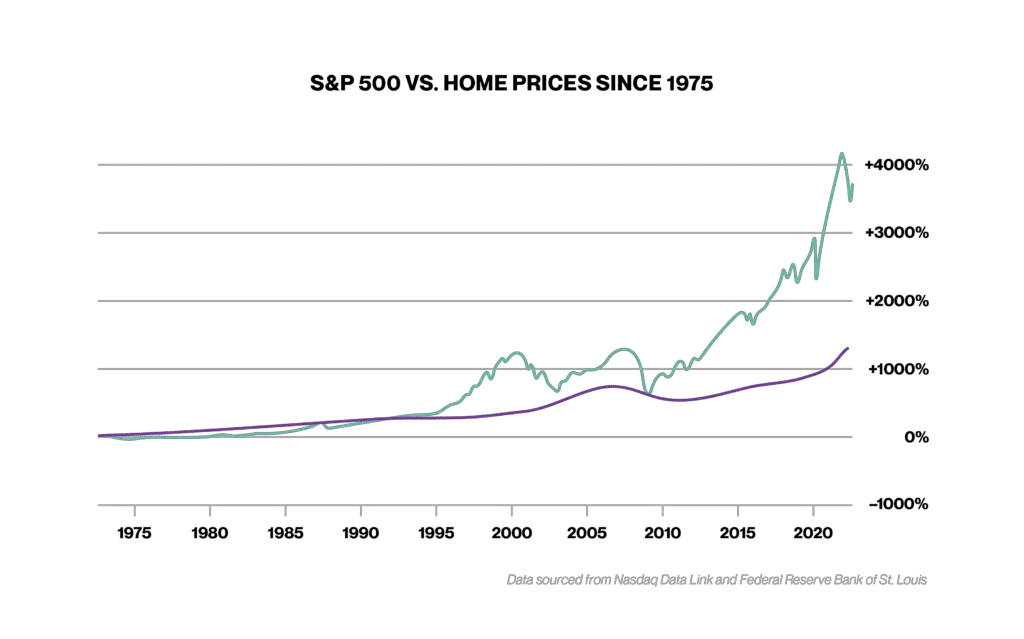

The following chart shows the volatility of the stock market compared to the housing market since 1975. The housing market rose slowly but reliably, while the stock market often dropped quickly before rising again, making it difficult for investors to get liquidity from their investments.

Movement of the S&P 500 vs. Home Prices

While the ROI for real estate has been historically slow but steady, in recent years, real estate investors have seen rapidly rising values, providing returns at much higher rates than ever before.

According to the National Association of Realtors, in 2021, home prices in more than two-thirds of metro areas rose by double-digit percentages. Areas like Austin, Texas; Phoenix, Arizona; and Punta Gorda, Florida, had appreciation rates over 25%. While the housing market appears to be cooling down, most experts predict high returns throughout 2022 and continued positive growth in 2023.

Fannie Mae predicts the annual appreciation rate of 2022 will be 10.8% before dropping to 3% in 2023. In contrast, the S&P 500 is in decline. As of June 2022, the year-to-date return had dropped to -20.58%.

If historical patterns continue to repeat, investors who are willing to wait out the highs and lows of the stock market will likely see their returns climb again after this downturn. But it’s difficult to predict the timeline for seeing values rise.

Historically, real estate investors have seen significantly less see-sawing of their investments than stock market investors. While investors may see small ups and downs, the quick volatility found in the stock market is unusual in real estate.

Ideally, investors would diversify their portfolios with a mix of both real estate and stocks to balance the stability of real estate with the potential for high returns in the stock market. But if you’re looking for a safe place to start with low risk, look at real estate investing.

2. Leverage Allows Wealth From Real Estate Investments to Snowball

Andrew Carnegie famously said, “Ninety percent of all millionaires become so through owning real estate.” Over a century after Carnegie’s time, real estate is still one of the most reliable asset class investments because of the ability to use leverage to grow your wealth. Leveraging a real estate investment means using borrowed money to purchase a property.

Dottie Herman, the CEO of real estate company, Douglas Elliman, explains, “Real estate is a bankable asset, so you can always leverage it. It also doesn’t tie up a lot of cash. You can put down as little as 10% and use banks’ money to grow your investment.”

Leverage makes it possible to own hundreds of thousands of dollars of real estate with a small amount of initial cash. For example, if you put 20% down on a $200,000 property, you need $40,000 in cash upfront. This is called equity. The other 80%, or $160,000, is leverage. As the home appreciates, you gain equity. You can turn that equity into leverage to finance future real estate investments.

According to The Motley Fool, the current national average appreciation rate is 2% month over month and 14.5% year over year, giving you a growing ability to borrow more money for your investment business.

How to Use Equity to Finance Additional Real Estate Investments

- Home Equity Loan: A home equity loan allows you to borrow from the equity you hold in your property. You receive a lump sum of cash that you can use to finance additional investments.

- HELOC: A HELOC, or home equity line of credit, also allows you to borrow money from your property’s equity. It works like a home equity loan, except the money is not distributed as a lump sum. Instead, a HELOC acts like a credit card, allowing you to withdraw money as needed. Many people use HELOCs to fund renovations or repairs on a property.

- Cash-Out Refinance: A cash-out refinance involves replacing your original mortgage with a new, larger mortgage. The difference in value between your original mortgage and the new mortgage is paid to you in cash, providing funding for future investments.

3. Invest in Real Estate to Beat Inflation

Inflation in the U.S. reached 9.1% in June of 2022, the highest it’s been since 1981. While inflation rates climb, investors are looking for options to protect their money from losing its value.

If you own a real estate investment property, inflation can benefit you. Let’s say you purchased a property in 2005 for $240,900, the median U.S. home value in that year. In 2005, the median monthly rent in the U.S. was $942. In today’s dollars, that’s $1,429. However, the actual median monthly rent in the U.S. has risen faster than inflation, reaching $2,002 in May of 2022.

As inflation increases, the rising market rate of rent allows you to more than double your income while your mortgage payments remain steady.

4. Save Money on Taxes With Real Estate Investments

Holly Parker, the founder and CEO of real estate brokerage, The Holly Parker Team, says, “Real estate has incredible tax benefits. In certain situations, you don’t have to pay taxes on your gains from investment properties.”

As a real estate investor, you’re running a small business, which means the cost of doing business can reduce your taxable income. In some cases, your business expenses may be high enough to reduce your taxable income entirely. Here’s a list of common deductions real estate investors receive:

- Mortgage interest

- Insurance

- Maintenance costs

- Property management fees

- Depreciation

- Property taxes

- Advertising

- Legal Fees

While this list covers the most common tax deductions, every real estate investor is unique. You may not qualify for all of these deductions and you may qualify for other less common deductions. As your investment portfolio grows, your finances will become more complex. You’ll want to work with a tax professional to make sure you’re not missing out on any tax savings.

Tax strategist, Karlton Dennis, explains how the most financially successful people work with tax professionals to ensure they’re getting the full tax advantages of their real estate investments.

“Taxes can get down to zero for real estate investors when the deductions they qualify for surpass the amount of annual income the property generates per year. When this happens, the real estate investor gets to enjoy what is known as tax-free cash flow,” Dennis says. “That is why so many high net worth individuals and wealthy families use this strategy to grow and protect their wealth and reduce their taxes over time and that’s also why they seek tax professionals who can guide them through their rental purchases.”

5. Improve Your Finances With Passive Rental Income

The passive income from rental properties makes it possible to boost your cash on hand without taking time away from the rest of your life. Some investors want the extra money to supplement their regular salaries, while others hope to quit working and live off rental income entirely. Both options are doable with the right investment properties.

Passive income is necessary for seniors who can no longer work, which is why many experts recommend investing in a rental property to help you in retirement.

Dr. Ken H. Johnson, a real-estate economist at Florida Atlantic University, says ideally, 50% of a retiree’s investment portfolio should be real estate. He explains, “In our research, we found that portfolios that have a mixture of stocks, bonds, and real estate outperform other portfolios.”

Things to Remember When Beginning Your Real Estate Investing Journey

While the benefits of real estate investing are significant, if you go into it without being fully informed, you can run into some things that can turn your investments into a headache. Here are a few things to be aware of so you can make the best decision.

Hire a Property Management Company for Truly Passive Income

In most cases, real estate investing is only truly passive when you work with a property management company. While you may be lucky enough to have a low-maintenance property that requires minimal effort on your part, there will always be some amount of work to do on the place.

Some types of properties require more effort to manage than others. For example, older properties need frequent repairs. You might also get a difficult tenant who needs more attention than most. If you have high tenant turnover, you’ll have to spend time finding and screening potential new tenants. And if you plan to operate short-term rentals, the workload increases tremendously.

If you don’t mind a little work in your free time, your first couple of properties may be easy to self-manage. But if you’re looking for truly passive income, find a property manager you can rely on.

Don’t Over-Leverage Yourself

An over-leveraged investor has far more debt than they have equity. Over-leveraging yourself can increase your risk of a negative return on investment. Keep at least 20% equity in your investments to maintain a safe amount of leverage.

Many lenders will allow you to purchase real estate properties with less than 20% equity, but it’s important to consider the downsides of borrowing more than 80% of the value of your property.

PMI

The unavoidable issue that arises when you invest in real estate with less than 20% down is private mortgage insurance, or PMI. PMI is an additional charge that will be added to your monthly mortgage payments. It’s meant to protect the lender in case you default on your loan.

PMI will typically cost 0.5-1% of the value of your loan annually. So, if you borrow $200,000, you’ll pay an extra $1,000-$2,000 each year.

Underwater Mortgage

When you over-leverage yourself, you risk becoming underwater with your mortgage. An underwater mortgage is a loan with a balance higher than the home’s value. This happens when a housing market cools down, and home values drop. If the homeowner had only a small amount of equity, they might owe more on their loan than their property can be sold for.

If you find yourself with an underwater mortgage, holding onto the investment often resolves the issue when the home’s value rises again. But for a while, you will be unable to sell your property without losing money.

Learn Real Estate Investing for Beginners

If you’re ready to start investing in real estate, the next step is to make a plan, figure out your financing, and find the perfect property. Learn how to do these things here: How to Get Into Real Estate.

With rumors of a recession on the horizon, some would-be real estate investors worry about whether now is the right time. To learn if you should get started right away or wait until later, read, “Is Real Estate a Good Investment in 2022?“