With a net worth of more than $16 billion, Ray Dalio is the 91st richest person in the world. But he wasn’t always wealthy. Dalio made his first investment of $300 at 12 years old with money he earned working as a golf caddy. By high school, he learned the power of small investments by tripling his money. This same philosophy would show him how to become a millionaire and later a billionaire further on in his life.

If you’ve set aside some cash for investing, you can follow Dalio’s example and begin building wealth. The key is to make well-informed investment decisions. To become a successful investor, look to the experts for top investing advice. Keep reading to learn how to invest $1,000 and make more money.

Key Takeaways

- Buying stocks from a variety of sectors decreases risk and allows investors to create reliable long-term wealth.

- The acquisition of new skills is the main contributor to higher salaries for employees, so an investment in learning can have a strong ROI.

- You should put money toward decreasing your debt only if the debt’s interest rate is higher than the rate of return you could get through investing.

- Due to high inflation, I bonds have a 9.62% rate of return in 2022, allowing them to act as high-yield savings accounts.

How to Invest $1,000 and Make the Most Money

1. Buy Stocks Through an Online Brokerage

Stock market investing is one of the most tried and true ways to grow your wealth. It’s a passive form of investing with relatively low risk to investors who are able to wait out any potential downturns in the market. Despite multiple economic downturns, the market has always recovered and allowed investors to build wealth.

If you’re new to stock market investing, you may wonder how to get started. The best option is to create an account with an online brokerage or investment app. While traditional brokerages often have high fees, most online brokers have eliminated or minimized commission fees, making this a more affordable option. Many of the best investment apps are designed specifically for beginners.

Here are a few of the best online brokerages that make it easy to choose where to invest $1,000 right now:

Buying Individual Stocks or Mutual Funds When Investing $1,000?

A mutual fund is a professionally managed fund that pools money from different investors to purchase a variety of securities. Mutual funds are inherently more diversified than individual stocks. However, they often come with higher costs.

Founder and co-chief investment officer at Fisher Investments Ken Fisher believes, in most cases, investors are better off purchasing individual stocks rather than mutual funds.

However, he explains, “One reason for investing in a mutual fund is because you believe somebody is a really good money manager managing that mutual fund and they’ll do better than you would do.”

Despite the benefits of having a financial advisor professionally manage the money in a mutual fund, Fisher believes it’s possible to do your own research and build a better portfolio by purchasing individual stocks. Eventually, those who manage their own portfolios often outperform those who do not.

Where to Invest Your Money in the Stock Market Right Now

If you choose to buy individual stocks, diversify your portfolio by buying stocks in a variety of sectors. Here are a few stocks to consider when investing $1,000:

Microsoft (MSFT)

At a current price of $238.48, this stock is forecasted to reach between $275.00 and $411.00 in the next 12 months.

- Information Technology Sector

- 28 of 31 analysts recommend buying now

Bank of America (BAC)

At a current price of $31.05, this stock is forecasted to reach between $34.00 and $55.00 in the next 12 months.

- Financials Sector

- 12 of 17 analysts recommend buying now

CVS Health (CVS)

At a current price of $97.78, this stock is forecasted to reach between $115.00 and $130.00 in the next 12 months.

- Healthcare Sector

- 9 of 11 analysts recommend buying now

Valero Energy (VLO)

At a current price of $97.89, this stock is forecasted to reach between $131.00 to $158.00 in the next 12 months.

- Energy Sector

- 11 of 11 analysts recommend buying now

2. Contribute More to Your Retirement Savings

Whether you have a traditional 401(k), Roth 401(k), or IRA, $1,000 investments in retirement can help you reach your retirement goals more quickly. Consider increasing the amount you put toward your retirement savings account each pay period. While you won’t be able to make a lump sum contribution, if you take an additional $80 out of your paycheck each month to put toward your investment, your earnings will add up.

While investing in your retirement account is a low-risk, passive investment, liquidity is low. If you need to access the money in your account before you reach retirement age, the IRS requires you to pay a 10% penalty on the income. This investment strategy is best for someone with reliable long-term gains in mind.

Which Retirement Savings Account Is Best for Investing $1,000?

401(k)

A 401(k) is an employer-sponsored retirement savings plan. Many employers have a policy of matching contributions to a 401(k) up to a certain percentage. While many people limit their 401(k) contributions to the amount their employer matches, you can contribute up to $20,500. The money you contribute to your 401(k) comes out of your paycheck before taxes. This reduces your taxable income, meaning your overall tax bill will be lower.

Roth 401(k)

A Roth 401(k) is also employer-sponsored. Contributions come directly out of your paycheck. However, these contributions are taken out of your earnings after taxes. This means you’ll spend more on taxes now, but when it comes time to withdraw money in retirement, unlike the traditional 401(k), the income from your investments will be tax-free.

IRA

IRAs are similar to 401(k)s, but these retirement savings funds are not employer-sponsored. IRAs are great for people who do not have access to an employer-sponsored 401(k). Yet, at $6,000 per year, the contribution limit is much lower.

Dustin Tibbetts of Jazz Wealth Managers believes that despite the contribution limit, the IRA may be the better retirement savings option because over half of people who participate in 401(k) plans keep their contributions low.

“If you’re not going to put more than $5,500 into a 401(k), then an IRA or Roth IRA is going to be a better bet for you because there’s more flexibility, more choices, and probably less fees,” Tibbets says.

3. Develop a New Skill

When thinking of ways to invest $1,000, many people first think of the stock market, real estate, or retirement accounts. But developing a new skill can potentially be a lucrative investment and help you make extra money. Continuing education should be a part of everyone’s personal finance strategy.

A 2022 study from economics professor Jérôme Adda of Bocconi University found that the acquisition of new skills is the main contributor to higher salaries. Whether you learn a skill that directly improves your performance at a job you already have, or you learn a skill that allows you to transition to a more lucrative career, education is a proven strong investment.

Another study from 2020 analyzed which skills have the highest earning potential. Investing $1,000 in any of these skills will pay off through your increased long-term earnings.

Here are a few of the top-earning skills:

- Python

- Ruby

- Agile

- Project Management

4. Pay Off Credit Card Debt

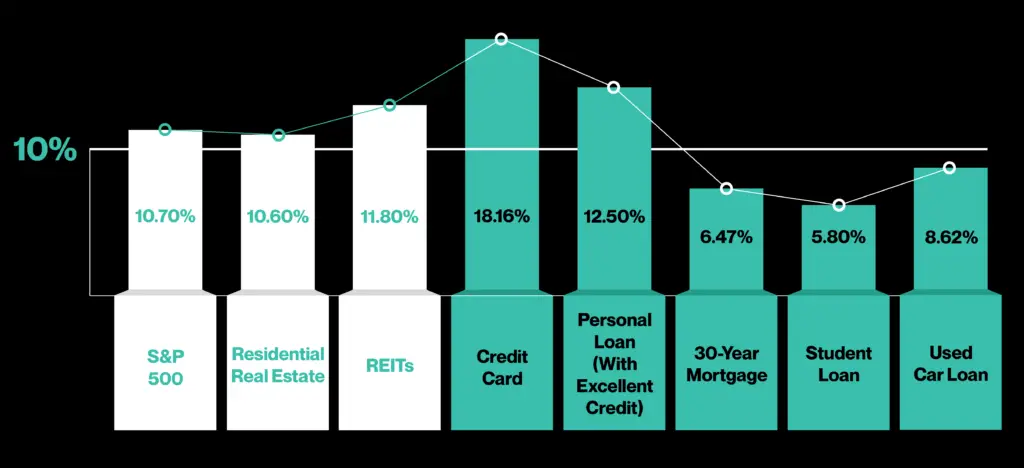

In 2022, Americans carried a balance on 54% of all credit cards. The average amount owed on those unpaid balances was $6,569. With average credit card interest rates at 18.16%, any extra cash you put toward paying down debt can significantly impact your financial well-being.

Should You Pay Off All Your Debts?

Many Americans also owe money on a car or a home loan. Others are working to pay off student loans and personal loans. If you don’t have credit card debt, you might wonder if you should put money toward these other debts.

A good rule of thumb is if you can beat the interest rate of your debt in the stock market, put your cash into stocks rather than toward paying off debt. While you may have other debts, these home loans, auto loans, and student loans are often low-interest rate debts.

The S&P 500 has an average annual gain of about 10.7%. As of September 2022, the average interest rate on a 30-year fixed-rate mortgage was 6.47%, meaning you will earn more money investing your cash rather than paying off your mortgage. Look at the interest rates on each of your debts to see how the rate compares to the returns you could get through investing.

5. Invest in I Bonds

An I bond is a savings bond that protects you from inflation. The interest you earn on money in an I bond is based on a combined fixed rate and inflation rate. During times of high inflation, I bonds can act as a high-yield savings account. In 2022, inflation rates hit a 40-year high. Consequently, the current return rate for I bonds is 9.62% through October 2022, which is nearly as high as the average annualized return of the S&P 500.

CEO of True Contrarian Investments Steven Jon Kaplan says, “Today’s I bond yield far surpasses that of any other government-guaranteed interest rate available from any bank, brokerage, or other insured source.”

I bonds are a good investment if you’re willing to sacrifice some liquidity. You cannot withdraw your funds for the first year of holding an I bond. Additionally, if you withdraw sooner than five years of holding, you’ll forfeit three months of interest. However, if you won’t require funds sooner than five years, this strategy can bring significant returns.

6. Start a Business

Many of the world’s most successful people built wealth through entrepreneurship. After a childhood of poverty, Ralph Lauren became a billionaire. Despite having very little money early in his career, he created one of the most successful fashion companies in the world.

Lauren explained the company’s humble beginnings, saying, “I used to go out and find rags and make them into ties, then I’d carry them to stores and sell them . . . One by one, the ties started selling, and people started talking about them.”

You don’t need a considerable amount of capital to start your business. If you have a good product or service and some knowledge of good business practices, a $1,000 investment can be enough to get you started.

Though entrepreneurship has built many people’s fortunes, opening a business is a high-risk, high-reward investment. According to data from the U.S. Bureau of Labor Statistics, 18.4% of U.S. private sector businesses fail within the first year. To increase your chances of success, choose your industry carefully, create a strong business plan, and research your competition. Although there is risk involved, this investment strategy can be highly fulfilling for investors who want a more active role in their wealth-building.

Top Investors Who Started With Less Than $1K

- Ray Dalio: Though he once earned money mowing lawns and delivering newspapers, Dalio is now the founder of the world’s largest investment fund. Dalio started investing at age 12 with $300. By high school, his investment had tripled, and his portfolio was worth several thousand dollars. Altogether, Dalio is now worth over $19 billion.

- Barbara Corcoran: Now worth over $100 million, Corcoran once had to scrape by just to get groceries. At age 23, Corcoran used a $1,000 loan to found her real estate business. That loan allowed her to multiply her wealth and end up with the fortune she has today.

- Leon Charney: After growing up in a poor New Jersey neighborhood, Charney started a business with only $200 in his bank account. Over the next few decades, he built wealth through his growing business and reinvesting his profits in real estate. Eventually, Charney had an estimated net worth of $1 billion at the time of his death in 2016.

Becoming Wealthy By Investing $1,000 Wisely Is 100% Possible

Regardless of the strategy you choose for investing $1,000 initially, it’s critical you continue to research smart investment choices. With the right knowledge, your $1,000 can grow into a major source of wealth.

Here’s a list of resources to check out to stay informed about the latest investment best practices:

- We Study Billionaires Podcast

- Fresh Invest Podcast

- The Financial Diet Youtube Channel

- ARK Invest Youtube Channel

- The Only Investment Guide You’ll Ever Need by Andrew Tobias

- Principles by Ray Dalio

Once you’ve learned how to invest $1,000 and you become more knowledgeable, remember the advice of Ray Dalio to diversify your investments, not just across sectors but also across asset classes.

“With 15 to 20 good, uncorrelated return streams, you can dramatically reduce your risks without reducing your expected return,” Dalio writes in the book Principles. “Making a handful of good, uncorrelated bets that are balanced and leveraged well is the surest way of having a lot of upside without being exposed to unacceptable downside.”

To learn more about building wealth through investing, check out these articles:

What to Know When Buying an Investment Property

How to Become Financially Independent

Learn About Getting Into Real Estate

Leaders Media has established sourcing guidelines and relies on relevant, and credible sources for the data, facts, and expert insights and analysis we reference. You can learn more about our mission, ethics, and how we cite sources in our editorial policy.

- Bloomberg. “Bloomberg Billionaires Index.”

https://www.bloomberg.com/billionaires/ - Fisher Investments. “Ken Fisher on the Benefits of Individual Stocks vs Mutual Funds and ETFs.”

https://www.youtube.com/watch?v=pDua9a383-o - TipRanks. “Microsoft Stock Forecast & Price Target.”

https://www.tipranks.com/stocks/msft/forecast - TipRanks. “Bank of America Stock Forecast & Price Target.”

https://www.tipranks.com/stocks/bac/forecast - TipRanks. “CVS Stock Forecast & Price Target.”

https://www.tipranks.com/stocks/cvs/forecast - TipRanks. “Valero Stock Forecast & Price Target.”

https://www.tipranks.com/stocks/vlo/forecast - Research Gate. “Sources of Wage Growth.”

https://www.researchgate.net/publication/355037158_Sources_of_Wage_Growth - HR News. “Skill Up: Which Skills Are The Best For Increasing Your Salary?”

https://hrnews.co.uk/skill-up-which-skills-are-the-best-for-increasing-your-salary/ - Lending Tree. “2022 Credit Card Debt Statistics.”

https://www.lendingtree.com/credit-cards/credit-card-debt-statistics/#credit-card-debt - Creditcards.com. “Average credit card interest rates: Week of September 21, 2022.”

https://www.creditcards.com/news/rate-report/ - Business Insider. “The average stock market return over the past 10 years.”

https://www.businessinsider.com/personal-finance/average-stock-market-return - Nerd Wallet. “Compare current mortgage rates.”

https://www.nerdwallet.com/mortgages/mortgage-rates - Oprah.com “Oprah Talks to Ralph Lauren.”

https://www.oprah.com/omagazine/oprah-interviews-ralph-lauren/2 - Lending Tree. “The Percentage of Businesses That Fail and How to Boost Your Chances of Success.”

https://www.lendingtree.com/business/small/failure-rate/#:~:text=18.4%25%20of%20private%20sector%20businesses,rate%20within%20the%20first%20year. - Forbes. “What Are I Bonds?”

https://www.forbes.com/advisor/investing/what-are-i-bonds/ - Forbes. “Leon Charney.”

https://www.forbes.com/profile/leon-charney/?sh=28b2aeb26476 - Barbaracorcoran.com. “About.”

https://www.barbaracorcoran.com/about/ - IRS.gov. “Retirement Topics – 401(k) and Profit-Sharing Plan Contribution Limits.”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits - Jazz Wealth Managers. “Should you invest in your company 401k retirement plan.”

https://www.youtube.com/watch?v=oYgKhWufRXs - Treasury Direct. “Series I Savings Bonds Rates & Terms: Calculating Interest Rates.”

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_iratesandterms.htm