Key Takeaways

- Bear traps result from incorrectly predicting a downward trend in a stock’s value.

- Bear traps are dangerous because they can lead to indefinitely high losses.

- Avoid short sales to ensure you’ll never end up in a bear trap, and invest in put options instead.

- Don’t predict market trends during periods of low trading volume.

- Manage investment risk by making data-informed predictions and using a stop-loss order when opening a short position on a stock.

What Is a Bear Trap?

A bear trap is the result of an incorrect prediction from an investor. When a downturn in a stock’s value appears to be imminent, bearish investors open a short position on the stock, hoping to profit from the downturn.

If the stock trends upwards instead of downwards, those in a short position are trapped in the trade. They must either cover their short positions and accept their losses or hope the trend will reverse. However, waiting for a trend reversal is dangerous because you leave yourself at risk of ever-increasing losses.

How Does a Bear Trap Work?

Bear traps are the result of investors participating in short sales of stock. A short position occurs when an investor borrows a certain stock and agrees to pay at a later date. The investor sells the borrowed stock for the current market price. If the stock price goes down, the investor pays the lender the lower price and makes a profit.

Unfortunately, if the price of the stock increases while the investor is in a short position, they can get stuck having to pay a much higher price to the lender than anticipated, potentially losing huge sums of money.

Example of a Bear Trap Stock in Action

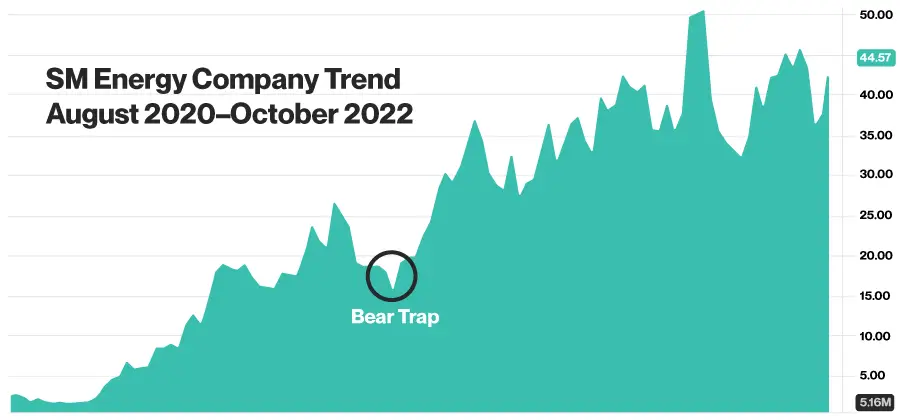

Throughout the COVID-19 pandemic, energy company stocks were volatile and difficult to predict. In 2021, many investors found themselves caught in a bear trap after opening a short position on SM Energy. Barron’s reported short sales of SM stock led to roughly -$248 million in losses for investors that year.

SM Energy’s valuation had been low throughout 2020 but began to climb in early 2021. When the value started dropping again between June and August 2021, bearish investors predicted the value would continue declining and return to 2020 levels. In late August 2021, the stock was valued at $15.26, and many investors had opened short positions, believing the value would continue to drop.

Unfortunately for investors in a short position, SM Energy’s value began rising in the fall of 2021, reaching $37.04 by November. Following November, the stock experienced some volatility but never dropped below $30 and, as of October 2022, is valued above $40.

Investors who entered a short position on the stock in 2021 were never able to regain the value lost.

5 Ways to Protect Yourself From Bear Trap Trading

1. Avoid Short Positions Altogether

The only way to guarantee you’ll never end up in a bear trap is to avoid opening a short position. Investment educator Christopher Gray explains, “Short selling is risky, especially during bear traps, because our losses can continue indefinitely.”

While there is risk in all stock trading, shorting a stock has additional risks that make it dangerous for inexperienced investors. When entering a long position on a stock, you will only ever lose the original value of the trade. But entering a short position puts you at risk of infinite loss because the value of the stock could continue to rise without limit. That’s why investor, strategic advisor, and YouTube host Brandon Beavis has never shorted a stock.

Beavis explains why he believes investors are safer and can achieve significant profits without short-selling stock, saying, “I tend to believe that over time if you look at the markets, they do push up more than they go down, especially if we’re looking at quality companies here . . . I’d rather just play the odds knowing that good companies over time should increase in value.”

Profit From Stock Market Downturns by Investing in Put Options Instead

A put option is a contract that gives you the right to sell or short a stock at a predetermined price. Put options offer a less risky alternative to investors hoping to profit from a market downturn.

Venture capitalist and award-winning MBA professor Chris Harron recommends purchasing put options rather than shorting stock commodities. “Buying puts is safer than shorting a stock as the most you can lose is the amount you paid for the put,” he advises.

Example

In early October 2022, Apple stock was valued at $145. A trader who believed the price of Apple stock would drop below $100 before mid-December could purchase a put option with a December expiration date for $0.71 per share. This would give the trader the right to sell shares at $100.

If the stock does not drop in value before the expiration date, the trader has no obligation to buy stock and resell it at the agreed-upon value. This is because, with the current market price, doing so would result in a loss for the trader.

However, if the stock’s value drops to $95 before the put option expires, the trader could purchase the stock for that lower price and resell it for $100, making $5 per share. If the trader chooses not to exercise the put option, the only value lost is the price the trader paid for the put option. In this case, it would be $0.71 per share.

2. Use the Relative Strength Index to Make Data-Informed Decisions

If you choose to short a stock, never simply go with your gut. Decrease your risk of making an incorrect decision by using data analysis to track price action. The relative strength index (RSI) is one of the most common tools for technical analysis. It allows investors to view price movements as part of a larger context. This makes it easier to predict if a change in value points to a pattern or if it’s an isolated event.

A financial analyst can help you perform the analysis needed to make decisions, but it’s always a good idea to understand the basics behind the tools your financial analyst is using. Calculate RSI with the following two-part formula:

Step 1:

100 − [100 / 1+ Average Loss / Average Gain]

*Typically, the average loss and average gain are calculated over a period of 14 days.

Step 2:

Step 2 can be calculated once you have 14 periods of data available.

100 − [100 / 1+ ((Previous Average Loss × 13) + Current Loss)) / (Previous Average Gain × 13) + Current Gain]

Traditionally, an RSI reading of 70 or above indicates an overbought situation, meaning the price is artificially high and should soon decrease to correct itself. A reading of 30 or below indicates an oversold condition, meaning the price will rise when the market corrects itself.

3. Don’t Trust Trends During Periods of Low Trading Volume

If you notice a trend reversal in the price of a stock, check to make sure the trading volume is high. Opening a short position on a stock during low trading volume could land you in a bear trap. This is because periods of low trading volume can cause false trends to appear. Wait for periods of high trading volume to make predictions about trends in the market.

During periods of low trading volume, the decisions of a few investors can stand out, appearing to be a trend. But these “trends” don’t give traders the full picture of average investors’ sentiments.

Important

Always check the daily trading volume and compare it with the Average Daily Trading Volume (ADTV). ADTV is the average number of shares traded per day over a period of six months.

4. Put a Stop-Loss Order in Place

Implementing a stop-loss order allows investors to minimize losses in the event that an investment does not pan out as expected. American billionaire and hedge fund manager Bruce Kovner says, “Whenever I enter a position I have a predetermined stop. I know where I’m getting out before I get in.”

Putting a stop-loss order in place while in a short position on a stock means you have instructed your broker to exit the investment and cover the losses when the value reaches a specific amount you have chosen.

Example

An investor might enter a short position while a stock is valued at $50 per share, and the greatest loss the investor is willing to accept would occur when the stock hits $60. With a stop-loss order in place, when the stock reaches $60, the investor’s broker will automatically exit the investment so the losses don’t continue to climb.

With a stop-loss order in place, you’ll never be in the dark about the level of risk you’re taking on. You can plan for the worst-case scenario while pursuing the best-case scenario.

5. Frequently Reevaluate Your Trades and Scale Appropriately

Never make a trade, especially a short sale, and let it go unmonitored. Watch as the market moves and scale your investment to control your level of risk.

Founder of Investors Underground Nathan Michaud encourages investors to watch their investments. This helps them take action as they see their investments move in either direction.

“Have I added too much? Then size back down. Is it doing what I thought? Great, then scale up a little bit,” Michaud says. “Reevaluate every step of the way.”

If you are heavily invested in a short sale, and the value of the stock has not dropped as rapidly as you anticipated, consider closing a portion of the trade to decrease your risk. You don’t have to entirely exit the trade if you still believe you’re in a good position, but scale back to control your level of risk.

What to Do If You’re Already Trapped in Your Trades

All investors find themselves in a bad trade at some point. If you get caught in a bear trap, it’s too late to practice risk management. Instead, it’s time to quickly take action. Follow these two steps:

1. Cut Your Losses

If you realize you’re invested in a bear trap stock, don’t hold onto the trade hoping the trend will reverse. This will only cause you to lose an ever-increasing amount of money. As soon as you know the stock is trending upward, cover your short position and cut your losses.

Important

If you wouldn’t open a short position based on the way the stock is currently trending, close the short positions you already have.

2. Learn From Your Mistakes

Co-founder of trading firm SMB Capital Mike Bellafiore gives advice to investors who find themselves in a losing position.

“Use this energy, this frustration—this energy of frustration—to map out solutions so you don’t feel frustrated again and execute on implementing solutions into your daily routine,” Bellafiore says. “Turn trading distress into trading progress.” In other words, once you’ve experienced a bear trap, follow sound risk management strategies to avoid finding yourself in that position again.

To learn more about investing, check out “How to Invest $1,000 Right Now.”

Leaders Media has established sourcing guidelines and relies on relevant, and credible sources for the data, facts, and expert insights and analysis we reference. You can learn more about our mission, ethics, and how we cite sources in our editorial policy.

- Barron’s. “These Were 2021’s Winning—and Losing—Short Sales.”

https://www.barrons.com/articles/2021-winning-losing-short-sales-51643336231 - Earn2Trade. “What is a Bear Trap in Trading And How to Identify It?.”

https://www.youtube.com/watch?v=zl2CeOt4p4A - Brandon Beavis Investing. “Why I’ll NEVER Short A Stock.”

https://www.youtube.com/watch?v=7kqodymnbhY - Chris Haroun. “Should You Buy Puts Instead of Shorting Stocks? (Finance Explained)”

https://www.youtube.com/watch?v=-QpFSSrWw0I - Yahoo Finance. “Apple Inc. (AAPL)”

https://finance.yahoo.com/quote/AAPL/options?p=AAPL&date=1671148800 - Turtle Trader. “Bruce Kovner: Top Market Wizard and Trend Following Trader.”

https://www.turtletrader.com/trader-kovner/ - Investors Underground. “Finding Your Niche As A Trader (Interview with Nathan Michaud)”

https://www.youtube.com/watch?v=PdDdxeJlk7w&t=0s - SMB Capital. “How to overcome a painful trading loss.”

https://www.youtube.com/watch?v=oriN6aSzd1c - Yahoo Finance. “SM Energy Company (SM)”

https://finance.yahoo.com/chart/SM#