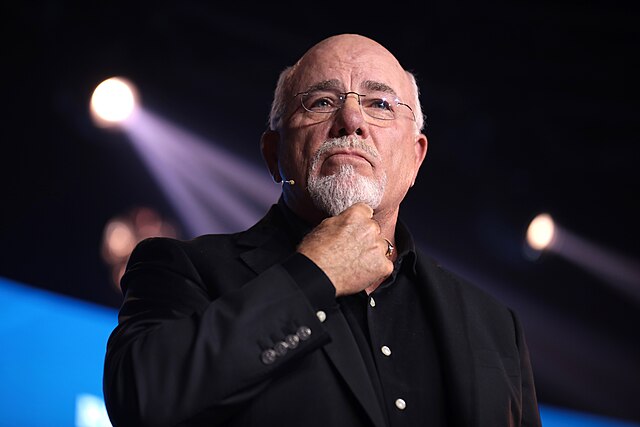

Financial guru Dave Ramsey is an expert on helping people repair their finances—and three important cuts are necessary to best harness income.

Key Details

- Income is the best wealth-building tool for anyone looking to grow their net worth, as most millionaires succeed through saving and investing their income, Ramsey argues in a recent radio monologue.

- “When you give your income to someone else, you don’t have it anymore,” he says. “When you give your income away, you have given up your economic future, all for crap.”

- He argues that “investing” in college degrees or accumulating credit card rewards is a horrible way to allocate money and that consumers should avoid excessive credit card use, taking out unnecessary student loans, and buying expensive cars.

- “Credit cards—stupid. Student loans—stupid. Car payments—stupid on steroids. Borrowing money on your house to put granite countertops in—somebody ought to smack you,” he says.

Why It’s Important

It is easy to be impulsive and borrow money today for easy pleasures like fishing boats, expensive cars, and granite countertops. It is also easy to follow the crowd on expenses that society tells us are good investments, like student loans, by taking out thousands of dollars of non-bankruptable loans on the promise of a better career.

But Ramsey argues that doing these things are irresponsible when avoiding spending can help accumulate money for retirement or college funds. He tells consumers to “think, think, think” about where they spend their money before they do it. There is no excuse for a society where the average car payment is $499 monthly when less expensive cars are available.

“If you take $500 a month and invest it from age 30 to 70, you’ll have over $5 million, and you scratch your head and wonder why you’re broke?” says Ramsey. “We’re fat and broke because we have no ability to do critical thought, and we don’t stop and look what we’re putting into our lives. This is nuts.”

‘When your money is tied up in monthly debt payments, you’re working hard to make everyone else rich. You work too hard to get to the end of your life and have nothing to show for it! Today is the day. Today is the day you can decide to change your life.”