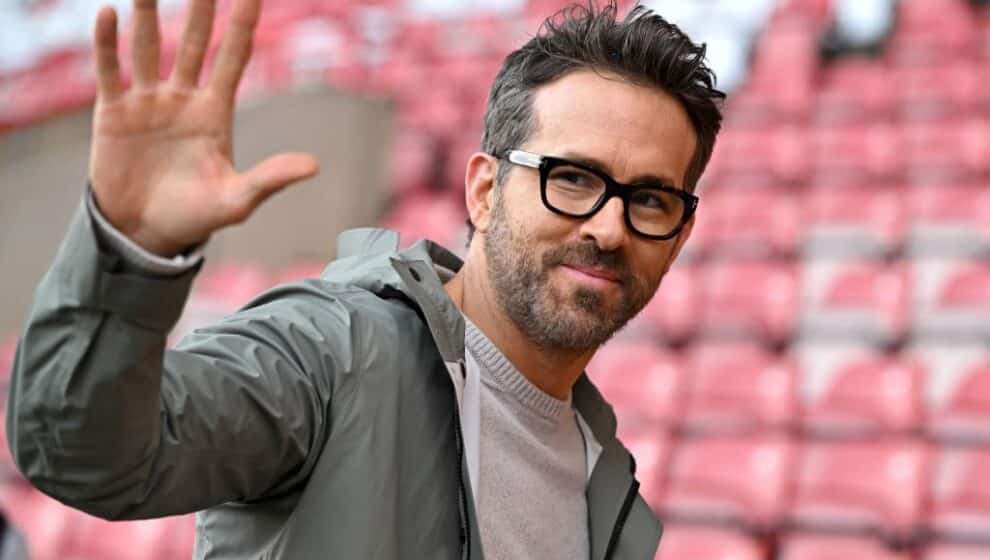

Actor Ryan Reynolds is not just successful in Hollywood—the movie star has also made a splash in investing.

Key Details

- After purchasing more than a 20% stake in Mint Mobile, Reynolds became the face of the phone company that he sold to T-Mobile for $1.35 billion, likely turning a significant profit for the star of Deadpool and Free Guy.

- Now the star is making his next investing move with Montreal fintech payments company Nuvei.

- By his own admission, Reynolds knows very little about fintech, but Nuvei has the strong brand foundations Reynolds looks for before investing.

- “My job is storytelling,” Reynolds says of part of the reason for his success.

Why it’s news

While Reynolds has successfully built his wealth over more than 30 years of acting, his successful investments and business ventures have been a significant contributor to his fortune.

The actor is estimated to have a net worth of around $150 million, according to Investopedia. In addition to the recent $1.35 billion Mint Mobile deal, Reynolds sold his own company, Aviation Gin, for around $610 million in 2020.

Reynolds’ investments have a great variety. He owns his own production and marketing agency called Maximum Effort, a telecommunications company, is an investor in Canadian wealth management service Wealthsimple, and co-owns a Welsh soccer team Wrexham AFC.

In a CNBC interview, Reynolds explained the common denominator in the seemingly random investments.

“If you look at a gin company, a wireless company, and a Welsh football club, those things don’t really go together,” he says. “But they all had strong brand foundations when I got there.”

After investing in a company, Reynolds often serves as the face of the company, starring in commercials promoting the product or service. His company, Maximum Effort, often facilitates these brand deals.

“My job is storytelling,” Reynolds says. “I think at Maximum Effort our job would be more defined as not necessarily financial investment but emotional investment.”

Nuvei, Reynolds’ latest investment, is a B2B company, making it a little different from previous ventures in the actor’s portfolio. Though Nuvei sells to businesses rather than customers, Reynolds still sees an opportunity to create value in the brand.

“The most successful B2B companies on the planet all have a story to tell,” he says. “For me it’s all about that creative. The financial investment side of it, I’m no wizard. The emotional investment side, that’s the part where I get the most fun.”