Economists are forecasting that student-loan cancellation will have a limited impact on borrowers and the economy.

Key details

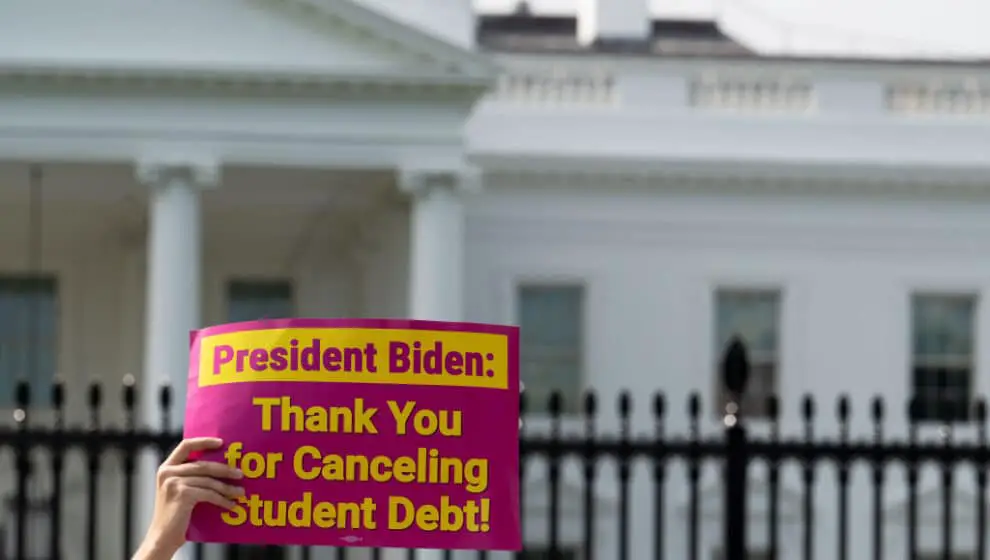

President Joe Biden announced on Wednesday that the U.S. government will partially cancel student loan debt for some 43 million borrowers.

His executive order creates a one-time forgiveness that will cancel $10,000 in debt for those making less than $125,000, plus an additional $10,000 relief for those who received Pell Grants. It also extends the ongoing pause on student loan payments to the end of the year.

Two economists from Goldman Sachs have released an assessment of the expected macroeconomic impact of the executive order and found that it will not create the impact that some are expecting. Joseph Briggs and Alec Phillips expect the impact to be negligible.

“If all borrowers eligible for the program enroll, it will reduce student-loan balances by around $400 billion, or 1.6% of GDP. That’s not a given—the economists point out that previous programs to reduce loan payments didn’t reach full enrollment,” reports MarketWatch.

Why it’s important

The $400-billion of deficit spending allocated to relieving student debt will have a nominal effect on spending power for borrowers. Briggs and Phillips claim the most benefit will go to middle-class borrowers, despite efforts to prioritize lower-class borrowers.

They expect personal income payments to decrease from 0.4% to 0.3%.

“Relative to a counterfactual where debt forbearance ends and normal debt payments resume, our estimates imply a 0.1% point boost to the level of GDP in 2023 with smaller effects in subsequent years due to the natural maturation of student loans, as well as continued growth in nominal GDP,” say Briggs and Phillips.

“Though lower-income households will see the largest proportional cut in debt payments, most of them don’t have student debt. The wealthy, on the other hand, are limited by the income thresholds attached to the relief. Middle-income households will benefit the most.”

Briggs and Phillips also expect an offset; that the overall combination of debt forgiveness and payment resumption will have a slightly negative impact going into 2023.

Backing up a bit

President Biden promised some amount of student loan forgiveness in his 2020 campaign. He points out that the cost of college has tripled since 1980 and that unpaid student loan debt has encumbered younger generations and slowed their opportunities to start families. Undergraduate students graduate with an average of $25,000 in debt.

“The skyrocketing cumulative federal student loan debt—$1.6 trillion and rising for more than 45 million borrowers—is a significant burden on America’s middle class. Middle-class borrowers struggle with high monthly payments and ballooning balances that make it harder for them to build wealth, like buying homes, putting away money for retirement, and starting small businesses,” says WhiteHouse.Gov’s Fact Sheet.

The Department of Education says it will announce how borrowers can seek loan forgiveness in the next few weeks.