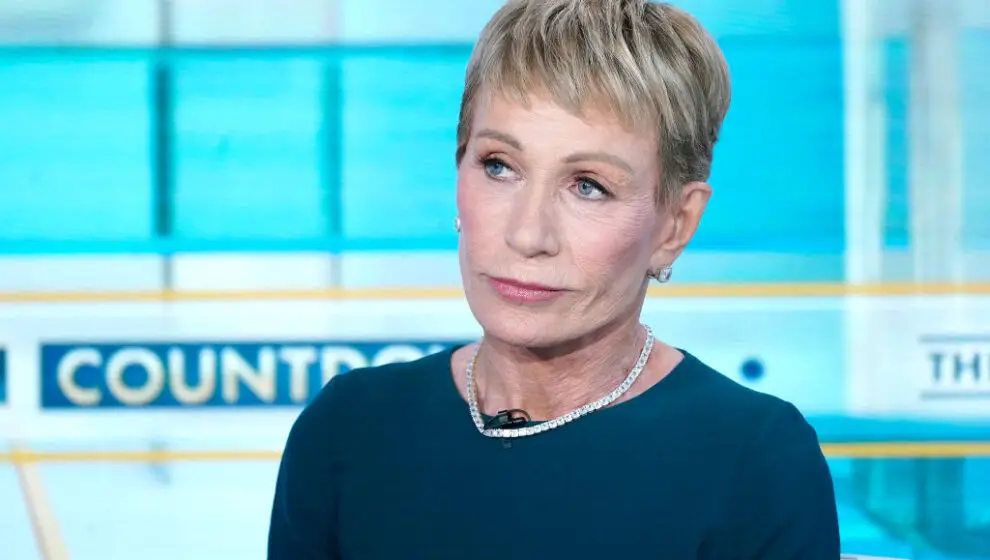

Real estate investor and Shark Tank star Barbara Corcoran has a dire warning for commercial real estate investors—the market will just get worse.

Key Details

- Corcoran warned that the commercial real estate market is going to get much worse before investors start to see any improvement.

- Post-pandemic, Corcoran says that there is little to no confidence in the overall real estate market as many office buildings remain empty.

- She echoed Elon Musk’s warning that “Commercial real estate is melting down fast.”

- Corcoran told FOX Business’ The Claman Countdown that she anticipates more businesses will default on loans, affecting regional banks.

- “I don’t see that turning around. I think it’s going to be a bit of a bloodbath before it gets better,” Corcoran says.

Why it’s news

The fate of commercial real estate is in a precarious position. As more businesses commit to full-time remote or hybrid work, business offices remain empty.

Even as large companies like Google and Amazon order their employees back to the office, occupancy levels are less than half what they were before the pandemic, Fortune reports. Security firm Kastle Systems found that the average office occupancy is 49%.

“No one really believes it’s going to turn the corner,” Corcoran says. “People are staying home. Our best office buildings in midtown Manhattan are 50% occupied, and in most major cities or in secondary cities, we have a 20% vacancy rate. No one wants to take that chance.”

As economic conditions such as inflation and rising interest rates continue to pressure the markets, Cocoran says this issue will only worsen, and more businesses will be forced to default on their mortgages. Eventually, she says, this will start to affect the regional banks.

Cocoran is far from the only expert suggesting this problem will worsen. In April, UBS Global Wealth Management said it expected to start seeing more defaults on real estate loans in the coming months.

At the end of March, Musk also warned that commercial real estate was “the most serious looming issue.”