Investors are looking with hope into the new year and seeing the new challenges and solutions awaiting them with a change in congressional control.

Key Details

- After the chaos over the election of the new Speaker of the House, the GOP-controlled House of Representatives has begun its work—following the opening of the new congressional session on January 3, 2023.

- The past year has seen significant economic change and upheavals following the war in Ukraine, supply-chain crises, the final waves of COVID-19, entrenched inflation peaking at 9.1%, record gas prices of $5.02 per gallon nationally, European energy shortages, the collapse of the crypto economy, the midterm election, and recession fears.

- Investors and financial institutions are looking forward to the new year now and considering how the new congressional session, federal reserve policy, and economic pressures will affect their work going into the new year.

- “Inflation and interest rate hikes will be the financial story of 2023. Those two components are the larger story,” says one investor.

Why It’s’ News

The recent changeover in the House of Representatives may not be a source of frustration for investors this year—as it is likely to fall into gridlock, as the Democrats control the Senate and Republicans control the House. The newly GOP-controlled House has yet to put forward significant financial legislation, and likely anything that passes will not pass the desk of President Joe Biden. The gridlock is good news for investors.

“Investors like stability. We don’t like surprises. If there is gridlock in Washington with the split congress, then that stability of being unable to pass laws can often be beneficial—as markets know what to expect. Federal spending policies will affect the market,” says financial strategist Stephen Patterson.

Breaking It Down

Stephen Patterson is the Chief Client Officer for Key City Capital in Southlake, Texas. His company works with accredited investors—individuals looking for growth or income-producing assets in real estate—and they have been affected by the economic challenges of the past year.

Speaking with Leaders Media, he reflected on the year ahead and the uncertainty that remains as financial institutions await significant decisions from the federal reserve, how the federal government approaches its new clean energy policies, and if gridlock will settle over Washington, D.C.

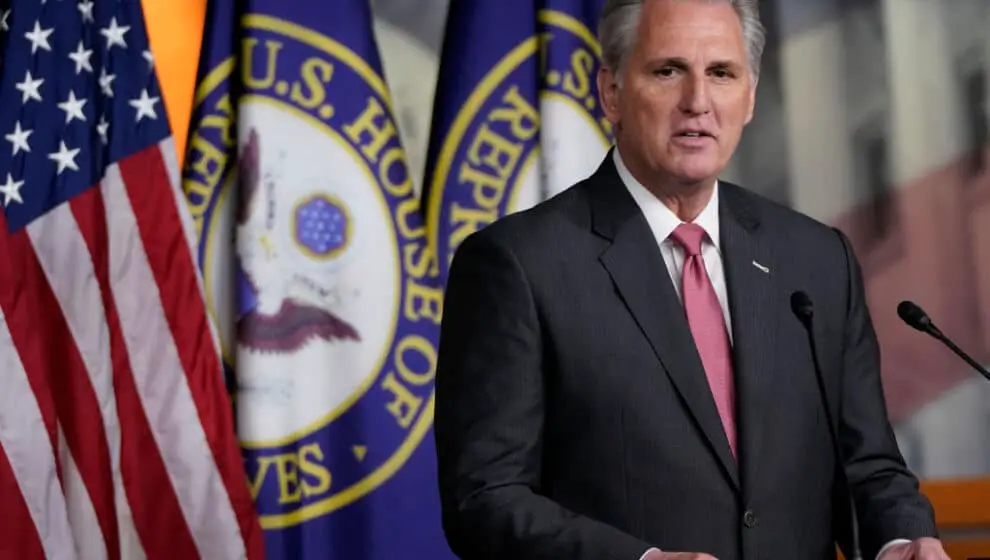

House Speaker McCarthy made many of his plans clear before the November Midterms in his Commitment to America, noting his financial plans include tackling high inflation rates, extending President Trump’s tax cuts, repealing the Inflation Reduction Act, eliminating clean energy tax credits, and increasing domestic supply chains and gas supplies. However, these plans will not likely pass the Democratically controlled Senate. The House may be more successful at blocking student loan relief and other legislation, though.

Key Takeaways

The recently passed $1.7-trillion omnibus spending bill passed by the previous congressional session reflected an incoherent policy from the federal government in its fight to uproot entrenched inflation.

The Federal Reserve continues to hike interest rates in an effort to slow the economy down and tighten monetary policy. Yet, the federal government is undoing the benefits of this with high spending. Such omnibus spending bills are unlikely to pass the current House, but it will take months for the full effects of multi-trillion dollar spending to hit.

“I would like to see congress and the Fed get on the same page—tightening policy and increasing spending takes us nowhere,” says Patterson.

For Patterson’s investors, he encourages his clients to play the long game and avoid the temptation to make quick decisions in light of the current pressures of the economy. There are smart ways to play the market during periods of high inflation, such as investing in assets like real estate, commodities, and energy that do well in such an economy. While interest rates will affect returns, he advises careful adjustments and prudent decision-making. Investors need to consider how the current market can be an opportunity.

“Interest rate hikes affect real estate performance. That’s something that we watch very closely, including inflation which has different aspects in our world that are good and bad. Aggressive interest rate hikes can certainly have an impact. It changes the amount of equity you can bring into a deal. The environment we’re currently in takes some risk out of the deal, though, so we’re able to use more equity and less leverage,” says Patterson.