Despite its reputation as a safe haven during inflation, gold is continuing to decline.

Key Details

- All the signs for a terrific year for gold were there, yet the precious metal has declined 10% this year.

- Gold-mining mutual funds are in an even worse state than bullion itself—many were off 20% or 30% this year and 40% down from a high in April.

- The Federal Reserve’s aggressive interest-rate hikes and a strong U.S. dollar are predominantly to blame for the diminishing value.

Why it’s news

Gold-mining companies have been hit particularly hard by the drop in value. Operational costs of the mining industry have risen, but the value of the product has dropped, making it impossible for the companies to pass the new costs along.

Mining companies are still profitable but the profit margins are shrinking. Where miners were once making around $750 per ounce of gold, they are now making about $400, Bloomberg reports.

Miners such as Newmont, Barrick Gold, and Agnico Eagle Mines don’t seem to be in any trouble yet—even with the drop in profit. The companies are still investing in ongoing mining projects, paying dividends, and buying back stock.

Some mining activity has been paused, such as the Yanacocha mine in Peru owned by Newmont.

Deputy portfolio manager of VanEck International Investors Gold Imaru Casanova says as long as prices stay relatively stable, there is no long-term cause for concern.

“The companies will be in good shape as long as the gold price holds here,” she says.

Backing up a bit

As gold continues to struggle, there are those who think a creative solution is called the answer.

Head of the World Gold Council David Tait thinks that it’s time for a massive overhaul of the gold market.

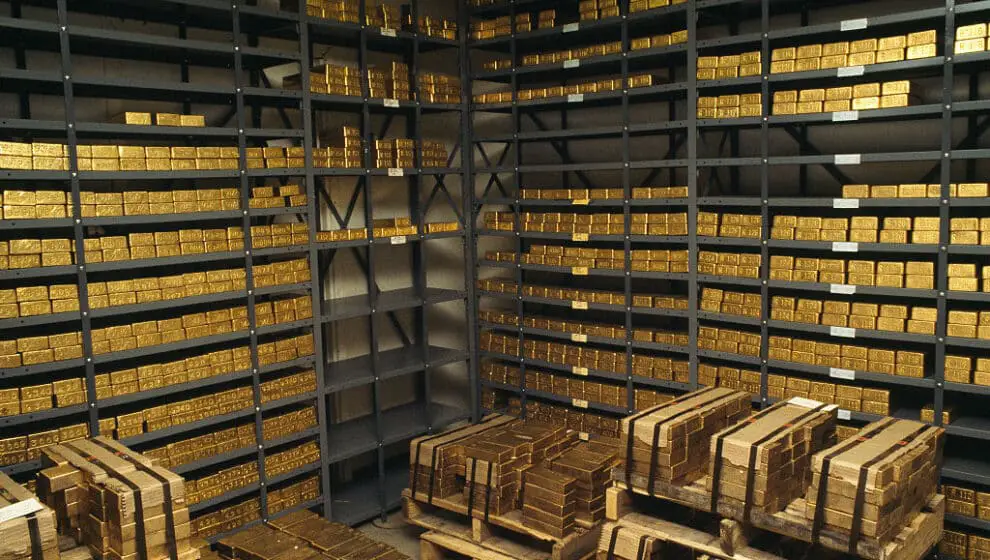

Currently, four major banks exchange around 50,000 gold bars in high-security vaults below ground in London. This archaic system is one of the oldest markets in the world.

The system contains around $500 billion worth of gold in various locations.

Tait’s plans include establishing a database to track the gold bars using blockchain technology. Once established, it would then be relatively simple to establish a digital currency backed by gold.