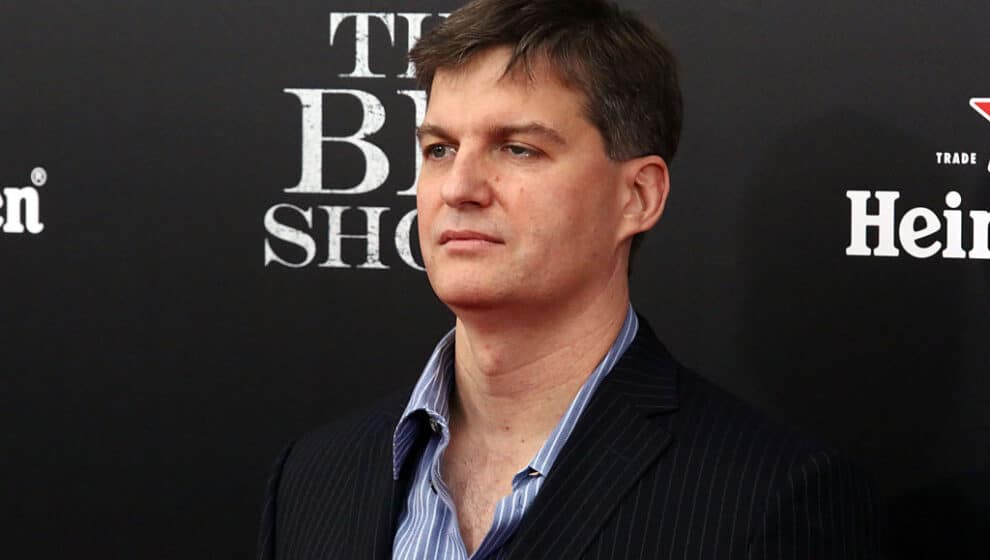

Michael Burry, an investor most known for his depiction in The Big Short, sent an ominous warning to investors this week, and it went unheeded.

Key Details

- On Wednesday, the Federal Reserve announced its eighth consecutive interest rate hike in the past 11 months.

- In a now-deleted tweet, Michael Burry, founder of the hedge fund Scion Capital and famous for shorting the market before the 2008 financial crisis, told investors to “Sell.”

- The tweet reflected an air of anxiety awaiting the Fed’s stated agenda to continue tightening monetary policy until it can force inflation under 2%, Bloomberg notes.

- Burry deleted everything on his social media profile on Wednesday and has turned down several requests for comment from different media outlets.

Why It’s News

Michael Burry is most known for his portrayal in the book and 2015 film The Big Short, starring Christian Bale, but he is also known for his ability to read the market and share cryptic investing advice on Twitter. His predictions of late have been very negative, saying that the U.S. government’s stimulus spending will cause another inflation spike and feed into a recession in the near future.

As we previously reported, Burry recently predicted a multi-year recession far worse than anything market analysts are predicting. Burry has a mixed history of predicting market crashes but successfully predicted the 2008 financial crash and a crypto crash in June 2021.

This cynicism puts Burry in good company. ARK Invest CEO Cathie Wood and Tesla CEO Elon Musk have similarly warned that the Fed’s tightening monetary policy is negatively impacting the economy in the long term and could even result in currency deflation if taken too far.

His warning to “Sell” before the Federal Reserve made its move suggests that he sees an incoming and precipitous market crash following the Fed’s attempts to create an artificial recession and stop entrenched inflation—inflation will simply become more entrenched, Americans will deplete their savings, and the entire economy will slow down for an extended period. Or he may be attempting to play the market again.

Notable Quote

Musk, who previously was criticized by Burry for overvaluing Tesla stock, took a jab at Burry on Wednesday by liking a that says, “Michael Burry deleting his account every time he shorts the local bottom will never stop being funny.” As Business Insider notes, Musk has dismissed Burry in the past as a “broken clock.”