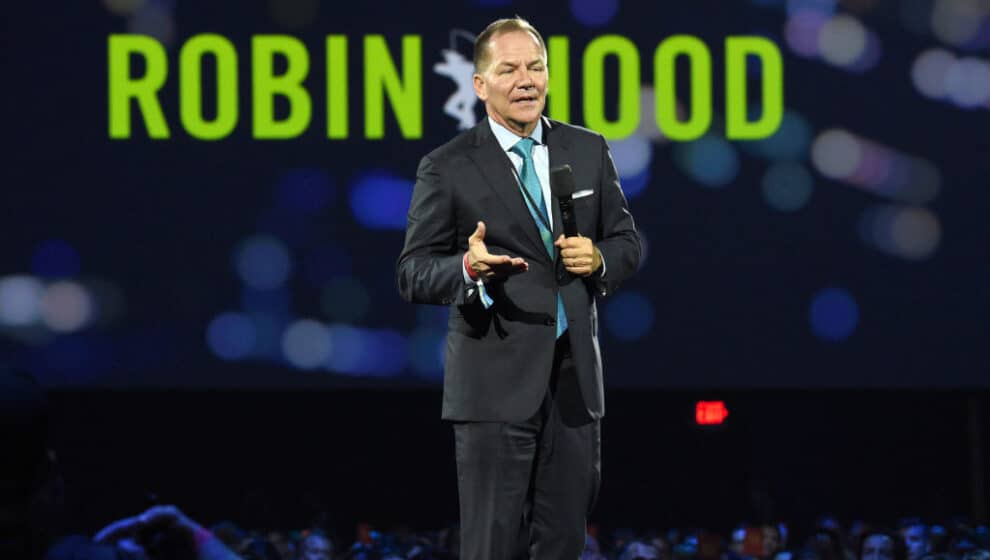

Paul Tudor Jones, the acclaimed hedge-fund manager and philanthropist, says that stocks could trend this year positively after the Fed hikes cease.

Key Details

- Speaking in an interview last Monday for CNBC’s Squawk Box, Jones argues that the Federal Reserve has reached its necessary peak to beat inflation and that the rest of the year will see improvements to inflation and the economy after the Fed officially stops raising rates.

- “I definitely think they are done. They could probably declare victory,” says Jones. “Equity prices … I think they’re going to continue to go up this year. I’m not rampantly bullish because I think it’ll be a slow grind.”

- While he has stated that a recession is possible in the third quarter, he compared the state of the economy to mid-2006 when stocks increased for more than a year after the Fed’s interest rate hikes halted.

- He predicts that within six months stocks will be up by 10% and interest rates will drop by 50 to 70 basis points.

- Jones also predicted short-term market volatility due to the ongoing debt ceiling debates.

Why It’s News

Jones is one of the most successful investors in financial history, and his record of reading the market has proven historically impressive. He is most known for having predicted the 1987 Black Monday crash, which has earned him a strong reputation.

He is not the only one to speak positively about the overall direction of the economy. Despite a tightening labor market, high inflation, high-interest rates, and decreased consumer spending, the U.S. economy has remained remarkably stable and resilient against the pressure of ten consecutive interest rate hikes in 14 months.

This unusual resilience has led many analysts to predict a soft landing and the hope that inflation will drop below 2% within the next year or two with minimal damage to the economy.

Notable Quote

“One of the world’s most-followed investors says that the Fed has finally raised rates enough to beat inflation. Paul Tudor Jones pointed out that the Consumer Price Index—a closely watched inflation metric—has slowed on a year-over-year basis for 12 straight months. That’s something that has never happened before,” says Stanley Research’s Matt McCall.