The Biden Administration proposes a new student loan repayment plan to reduce monthly bills and cut some loans in half.

Key Details

- The plan is to transform the current income-driven repayment plan, Revised Pay As You Earn, that caps bills based on income.

- Individual borrowers making less than $30,600 annually and any borrower in a family of four who makes less than about $62,400 will be offered $0 monthly payments, according to the Department of Education.

- The revision plan could lower some borrowers’ monthly loans from 10% of monthly income to 5%, cutting it in half for borrowers not falling in the $0 monthly loan category.

- If passed, the plan could go into effect in July 2024, but some parts of it could be enacted sooner.

Why it’s news

The U.S. has more than $1.6 trillion in federal student loan debt, which is slowing the national economy.

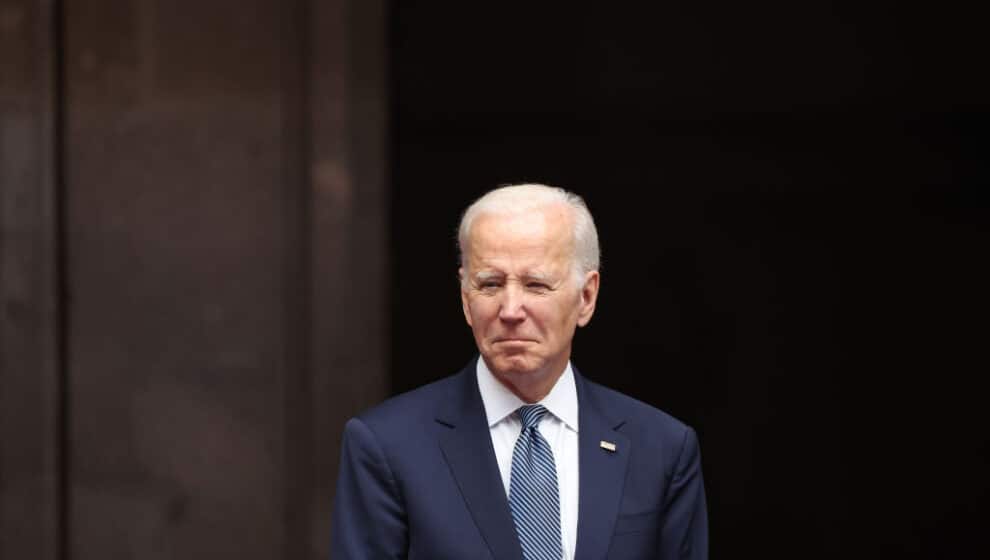

To boost the economy, President Biden has been working on a student loan plan to forgive some student loans and help others pay their debt off more easily.

The newest step taken by the Biden Administration is revising the current income-driven repayment plan—Revised Pay As You Earn. This plan is the most affordable payment plan option but remains a burden for most working-class families.

The new revisions fulfill promises made in August and will help borrowers find more manageable student loan payment plans based on income. It will reduce the monthly cost for most low and middle-class families.

“Today, the Biden-Harris administration is proposing historic changes that would make student loan repayment more affordable and manageable than ever before,” says U.S. Secretary of Education Miguel Cardona. “We cannot return to the same broken system we had before the pandemic when a million borrowers defaulted on their loans a year, and snowballing interest left millions owing more than they initially borrowed. These proposed regulations will cut monthly payments for undergraduate borrowers in half and create faster pathways to forgiveness, so borrowers can better manage repayment, avoid delinquency and default, and focus on building brighter futures for themselves and their families.”

The Administration is also holding educational institutions accountable for leaving the student with excessive debt. If a secondary education institution leaves a student with unaffordable debt, it could be issued a warning by the U.S. Department of Education.