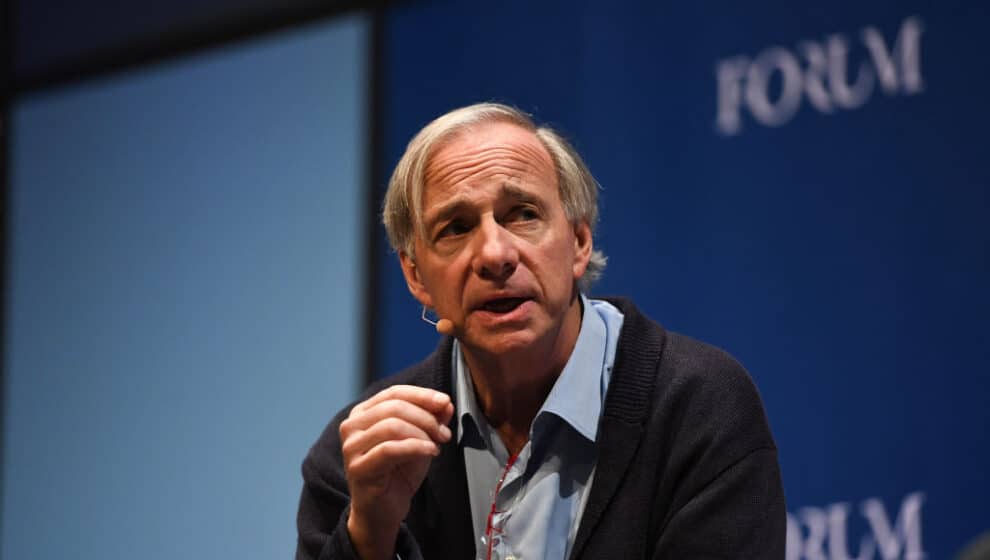

Bridgewater Associates founder Ray Dalio warns investors that the Silicon Valley Bank (SVB) collapse is part of a larger problem as assets acquired through borrowed funds are losing value.

Key Details

- When interest rates were low, banks had access to cheaper investments, Dalio explains in a video posted last week. But now that the Federal Reserve has hiked up rates, those investments have lost value.

- “Everybody (is) losing money,” Dalio says. “And that is a pervasive situation that exists throughout the economy, the world economy, the U.S. economy.”

- The solution, he suggested, is a difficult one. The Fed must balance a high enough interest rate to counteract inflation with a low enough rate to keep investors afloat.

Why it’s news

The market imbalance could grow worse in the coming years if the Fed does not find a way to keep inflation low and investors happy, Dalio says. If left uncorrected, borrowing will increase as the federal government tries to deal with growing budget deficits. Typically, the government would try to counteract this deficit by selling debts like the U.S. Treasurys, but this will be unsuccessful if investors cannot predict a high enough rate of return.

“If they don’t have a high enough real return, they can sell the debt or the debt that they’re holding, rather than buying that debt. And that creates a terrible imbalance,” he says.

However, if rates are too high, the market could see a repeat of the SVB collapse. Higher rates drag down bond holdings, causing difficulties for the holders when it comes time to sell. SVB lost $1.8 billion after selling a bond portfolio, which resulted in the run that eventually collapsed the bank.