Investor optimism around a potential blockbuster obesity drug by Structure Therapeutics led to soaring share prices across the weight-loss pharma sector.

Key Details

- Structure Therapeutics’ stock jumped 35% after reporting positive results from early clinical trials of a once-daily weight-loss pill.

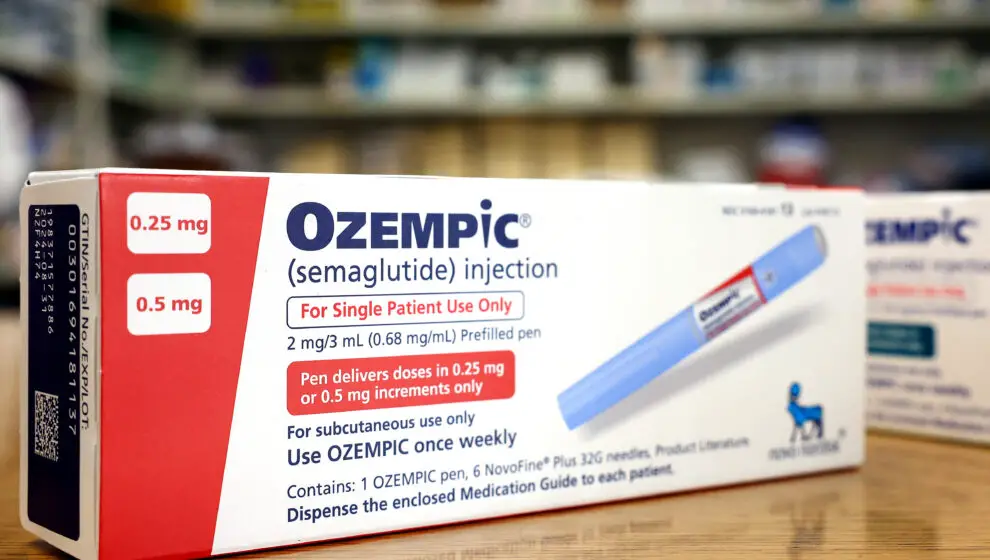

- The experimental drug helped participants lose about 5% of their body weight over one month without side effects, although there are concerns with Ozempic.

- Analysts predict the global anti-obesity medication market could reach sales of $100 billion by 2030, up from $71 billion currently.

- With promising growth prospects, investors are betting on companies developing new weight loss drugs like Structure, Eli Lilly, Novo Nordisk, and Pfizer.

Why It’s Important

The clinical trial results from Structure Therapeutics’ experimental weight loss pill caused a surge of investor interest in the company and the broader obesity drug market.

Structure’s shares skyrocketed 35% on the news that its pill helped overweight participants lose 5% of their body weight after just one month of treatment—the drug works by enhancing feelings of fullness and reducing appetite.

Analysts say Structure’s drug could become a blockbuster, with the global anti-obesity medication market expected to grow significantly in the coming years.

Guggenheim analyst Seamus Fernandez predicts sales of $100 billion by 2030, more than double the $71 billion forecast for 2022. Driving growth is the class of GLP-1 medications like Eli Lilly’s Mounjaro and Novo Nordisk’s Wegovy.

With an influx of new competitors, the field is getting more crowded. Pfizer recently reported positive data from a Phase 2 trial of its GLP-1 pill.

But Structure’s pill has a key advantage over rivals if approved—it is taken just once a day rather than requiring weekly injections. Analysts say this could make it more appealing and widely adopted.

The excitement around Structure shows that investors are hungry for new obesity treatments amid forecasts of surging demand. Though potential side effects and high costs could limit market size, analysts still see huge sales potential as rates of obesity continue to climb globally.