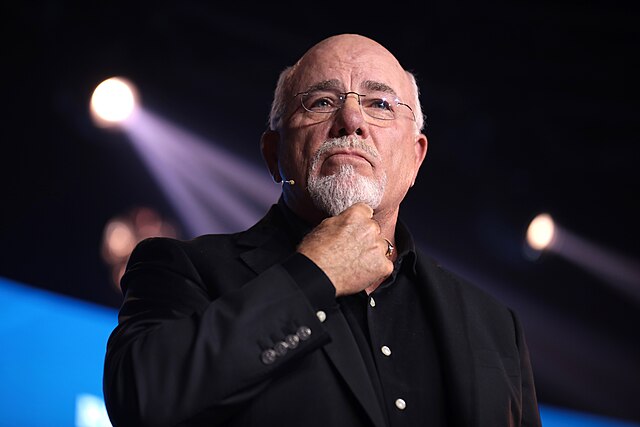

Financial strategist Dave Ramsey argues that low-income earners can often have an easier time retiring as millionaires than high-income earners due to savvy spending and investing.

Key Details

- Ramsey Solutions released its The National Study of Millionaires earlier this year, which shows the jobs that best build wealth, stating that 79% of millionaires have received no inheritance.

- The study found that the five best jobs for becoming a millionaire are engineers, accountants, teachers, managers, and attorneys.

- The study proves that “millionaires are made, not born” and that individuals with comparatively low income can retire with significant savings.

- As Ramsey noted on the July 22 episode of his show, “You can’t earn your way out of stupidity.”

Why It’s Important

The average teacher in the U.S. has a median salary of $61,000 annually. However, low income does not mean those individuals are doomed to financial ruin in their retirement years. As Ramsey notes, “Income is your most powerful wealth-building tool.” Low-income earners can still make decisions that mathematically build up to large gains over time.

“[Teachers] are systems people. They work with a set of principles, and they don’t have free rein to make up their own rules. When you are a lawyer, and you go before the judge, you have to follow exact procedures. … You don’t have a choice. You don’t have a choice when you are designing a bridge. There is one way; otherwise, it falls,” he says.

The keys to accumulating wealth are methodical spending and steady investment over time. Doctors conversely make a median income of $294,000 in the U.S., but they leave college with $200,000 in student debt which can take over a decade to pay off—largely wasting time and money that could be put toward investing in the future. As a result, doctors less frequently become millionaires by their retirement.

Notable Quote

“It’s very easy to be distracted and not be able to focus on things like finances, especially if you have a high income. You think, ‘Everything is okay … that’s my security; I don’t need to worry about having a budget. Why do I need to know about my cash flow?’” author Sarah Stanley Fallaw tells Ramsey.

“A lot of us are making consumer decisions that are influenced by the people around us and certainly with that high income and the influence of other people—especially if those other people have really high incomes, too—we tend to do things that are not in our financial best interest, especially early on.”