Investor Michael Burry has admitted he was wrong when he implied that the stock market would fall in early February when he tweeted then deleted “sell.”

Key Details

- Scion Asset Management investor Michael Burry is a hedge fund manager best known for being depicted by Christian Bale in the movie The Big Short, based on Michael Lewis’ best-selling book of the same name.

- On January 31, he offered a cryptic tweet “sell” prior to the announcement of the most recent interest-rate hike, implying that the market was about to fall, as he has been saying for months.

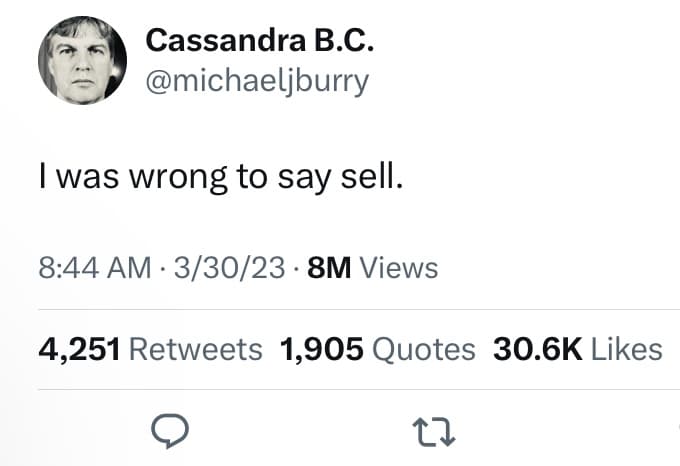

- Burry backtracked on Thursday, March 30, offering a mea culpa for his prediction by tweeting and later deleting: “I was wrong to say to sell.”

Why It’s News

Michael Burry is well known for his dramatic public announcements and predictions—and is routinely quoted by the media when he prognosticates about the market and economy. His pronouncements usually suggest that the market is overvalued and doomed to crash—as was the case when he gained fame some 15 years ago.

He runs a Twitter account where he shares music and investing advice. He has been known to tweet his ominous predictions before deleting posts.

Burry became well known for predicting the housing-market crash and subsequent 2008 financial crisis, betting against the market in the process and winning.

As his Thursday tweet suggests, he is not always right. These days, the current economy is working against traditional wisdom, as spending and unemployment are at record highs despite a 6% inflation rate and predictions of an upcoming recession.

U.S. stock market trends have remained resilient against the backdrop of a banking crisis, high inflation, high interest rates, and the stress of an ongoing war in Eastern Europe—which is more impressive in light of the volatility of the bond market, Bloomberg notes.

In a second Thursday tweet, Burry encouraged his followers to buy into the dip, or BTFD, saying, “Going back to the 1920s, there has been no BTFD generation like you. Congratulations.” He encourages his readers to buy assets while the market is in momentary decline, a respected investor practice.