Despite having many notable red flags, many investors continued to put money into crypto exchange FTX.

Key Details

- The recent fallout of crypto exchange platform FTX was a big shock to the crypto community—especially the platform’s investors.

- Many companies did plenty of research before investing millions into the exchange platform, but failed to see the redflags attached to it.

- The fallout has caused many investors to have to write off millions in investments…

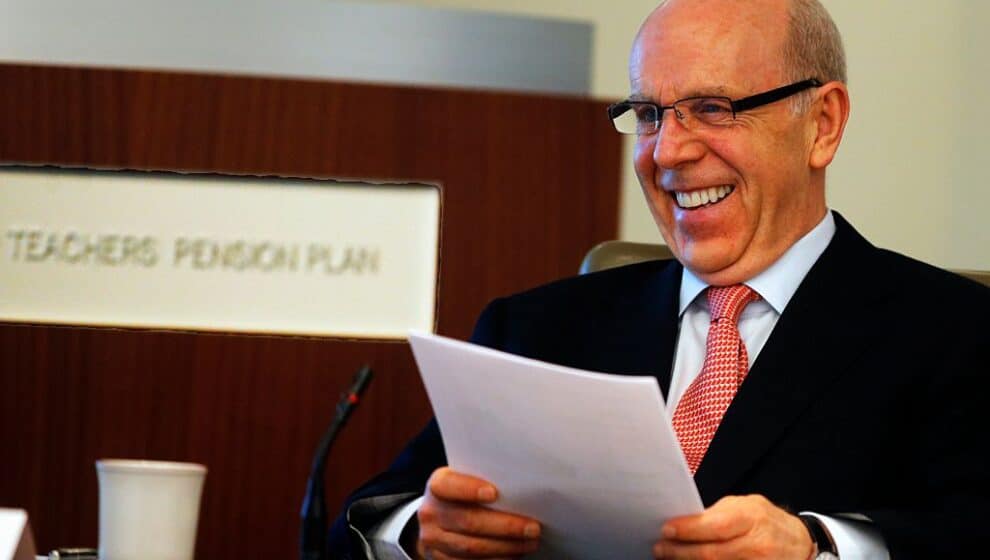

- The Ontario Teachers’ Pension Plan had to write off $95 million.

- Sequoia Capital will likely lose $150 million.

- Temasek is looking at a $275 million loss.

- SoftBank, a multinational holding company, will likely not get any return on its $100 million investment.

Why it’s news

FTX was one of the world’s biggest crypto exchange platforms before it came crashing down earlier in the month.

The failure of the large crypto exchange came as a surprise and brought fear to the sector causing many holders to sell causing many digital coins to drop quickly.

The fall of the platform happened very fast and left many people confused as to what happened and it turns out it was linked to risky bets gone wrong that the CEO called a poor judgment decision.

The fallout hurt many others including—the platform’s investors.

FTX CEO Sam Bankman-Fried was able to secure many big time investors for the platform that invested millions into the risky company.

One of the investors was The Ontario Teachers’ Pension Plan who invested millions into the failed platform. The company put $75 million into two FTX entities in October 2021 then followed up with another $20 million three months later.

The thing about this investment is—the company did research on cryptocurrencies for years before deciding to invest money and saw FTX as a good investment missing all of the company’s red flags.

“Prior to making an investment, our investment teams spent years tracking the digital asset space,” says Teachers spokesman Dan Madge. “TVG’s thesis was that exchanges, such as FTX, could help refine our perspectives around digital assets without exposing the plan to significant, single cryptocurrency risks. TVG spent many months on diligence of FTX, in partnership with experienced external advisors, to allow us to assess the risks associated with the investment.”

The company is now writing off its entire investment and stated that “no due diligence process can uncover all risks especially in the context of an emerging technology business.”

Other Major Investments

The Ontario Teachers’ Pension Plan wasn’t the only big investor into the crypto exchange.

FTX had a long line of investors including: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock and Thoma Bravo, according to TechCrunch.

Many of these like Ontario Teachers did extensive research into crypto before investing, but ultimately lost out due to the exchanges’ fall from grace.