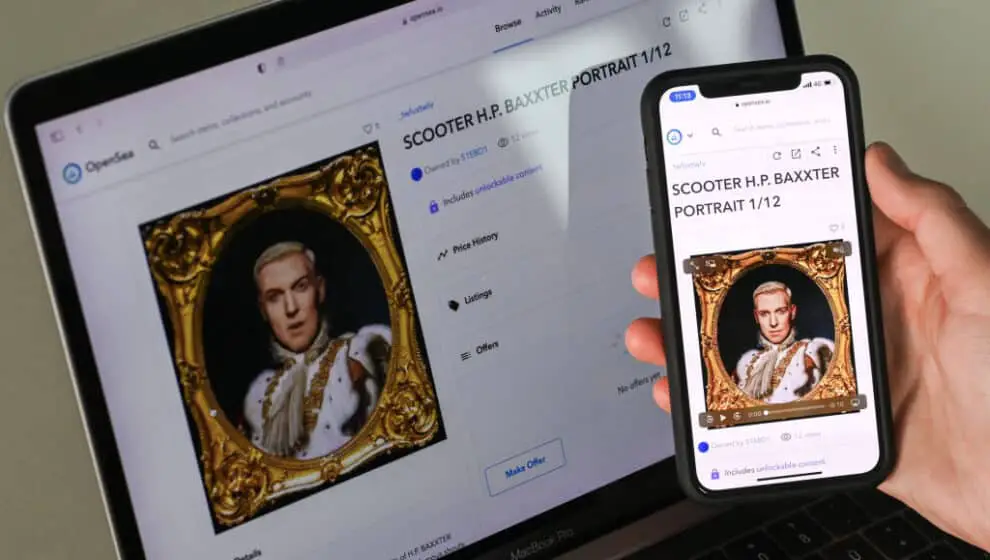

Non-fungible token (NFT) marketplace OpenSea made a significant change to its policies on February 17 when it announced that it would make its royalty policy for creator earnings optional for multiple NFT collections.

Key Details

- The decision was made to meet competition in the market, with other marketplaces dropping transaction fees and royalties, which Wrap Pro describes as a “race to the bottom” strategy.

- The decision has earned OpenSea acrimony from creators, who felt betrayed by the marketplace for undermining creator royalties.

- NFT artists can no longer necessarily rely on regular sales royalties for a passive income from their work, which the marketplace’s previous policies protected, one of the key appeals of selling NFT artwork for creators.

- OpenSea says this is limited to specific NFT collections and doesn’t reflect the policies of the market, which is trying to preserve royalties for NFTs that don’t shift between marketplaces.

Why It’s Important

The decision and its backlash are occurring as the NFT marketplace continues to dry up. As we previously reported, marketplaces have decreased in volume and sales prices as the lucrative market for digital artworks has shrunk as much as 99%, according to Reuters. This has left marketplaces with difficult decisions, whether to stand by their creators or to rush for what little transaction activity they can foster in the short term by cutting fees and requirements.

OpenSea CBO Shiva Rajaraman, speaking with Wrap Pro, says that the website is still committed to preserving royalties and that there is confusion about policy changes. He says that the only specific NFT collections being affected are ones that can’t be exclusively bought and sold on OpenSea, noted with an “operator filter” that distinguishes between them. However, the company appears to be “hedging its bets” regarding that commitment, according to the interview.

With 80% of NFT sales happening on marketplaces with less enforcement for creator royalties, OpenSea’s policy changes reflect the challenges of staying competitive in a shrinking marketplace. “While we continue to uphold on-chain enforcement through the operator filter, we’re moving to a different fee structure that reflects the needs of today’s ecosystem,” says OpenSea.

Notable Quote

“There’s been a massive shift in the NFT ecosystem. In October, we started to see meaningful volume and users move to NFT marketplaces that don’t fully enforce creator earnings. Today, that shift has accelerated dramatically despite our best efforts. We’ve worked to defend creator earnings on all collections when others didn’t. And when we introduced the Operator Filter, it was our belief that on-chain enforcement was the best way for creators to secure their revenue stream from the ongoing resale of their work,” says OpenSea.