Ride-hailing companies Uber and Lyft have both seen significant growth in their advertising businesses—both rooftop display and in-app.

Key Details

- Uber passed $500 million in annual run rate with more than 315,000 businesses running advertisements with the company in the fourth quarter—nearly doubling the number from the year before, according to Uber.

- While Lyft didn’t give an exact number, Chief Business Officer Zach Greenberger says the company exceeded goals, and its ad revenue increased “nearly seven times” in the fourth quarter compared with the previous quarter.

- Uber began letting businesses target ads to customers using their data of specific destinations and ride histories to give ads pertaining to their previous activity, which has helped boost its ad revenue.

Why it’s news

Ad growth for ride-hailing companies Uber and Lyft, have both risen significantly in the last few months.

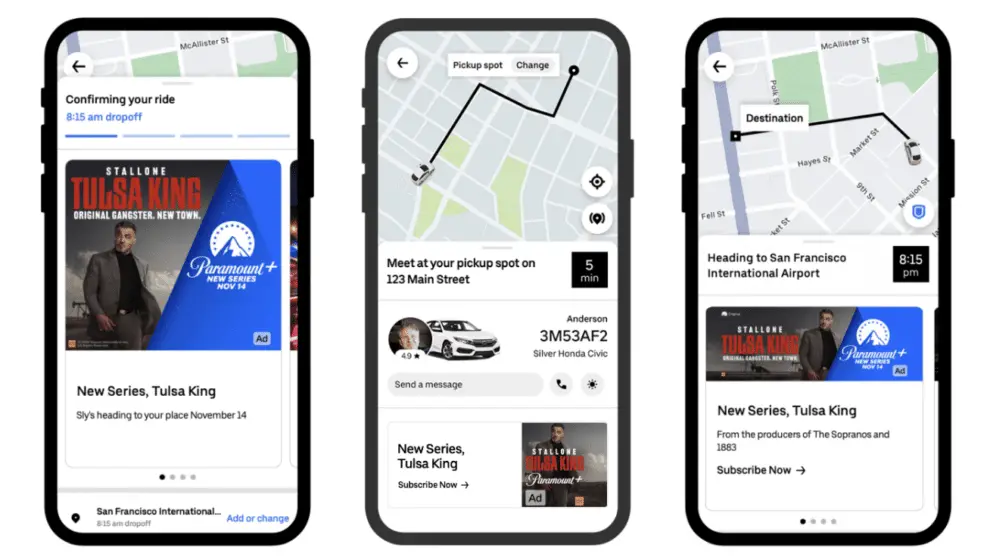

Uber passed $500 million in annual run rate, with more than 315,000 businesses running ads with the company in the fourth quarter. The company began letting brands target ads to customers before, during, and after their rides, using data about their specific destinations and ride histories.

Uber also sells ads on its food-delivery app UberEats and began allowing brands access to post-checkout ads. The company says it sees growth within this sector because Lyft does not have a similar food-delivery app, and only 25% of the companies selling products through Uber Eats are buying ads on the platform.

The company says it is targeting $1 billion in annual ad revenue by 2024, according to Uber CEO Dara Khosrowshahi.

Lyft didn’t disclose exact earnings, but Chief Business Officer Zach Greenbergerthe company’s ad revenue growth has exceeded its goals and has increased “nearly seven times” in the fourth quarter.

Lyft charges $2 for 1,000 consumer impressions for its rooftop display ads on vehicles, while Uber charges $5 per 1,000 impressions for the same ad type. Uber also charges $45 per 1,000 impressions for in-app ads and has 3% click-through rates, according to CEO Khosrowshahi.

Analysts say it’s still early with ride-sharing ads to predict future outcomes, but the companies seem to be doing well, and Uber’s strategy is similar to that of Amazon, which has done exceptionally well in the ad space.