Initially, Russia’s invasion of Ukraine brought a spike in revenue for the invading country as demand for oil and gas rose, but that is coming to an end as the Russian economy struggles to produce.

Key Details

- A series of Western sanctions on Russian gas and oil have cut into one of the country’s most significant sources of revenue.

- Its largest exports—gas and oil—have lost major European customers. The ruble has declined 20% since November, and the country’s labor force is shrinking as more young people flee the country or are drafted.

- The economy struggles to grow as uncertainty surrounding the economy and the country’s fate have dissuaded any significant business investment, The Wall Street Journal reports.

- While the country’s current economic struggles may not be enough to halt the ongoing war, the Russian government could face a choice between military expenses and social spending that has largely protected civilians from feeling the shortages.

Why it’s news

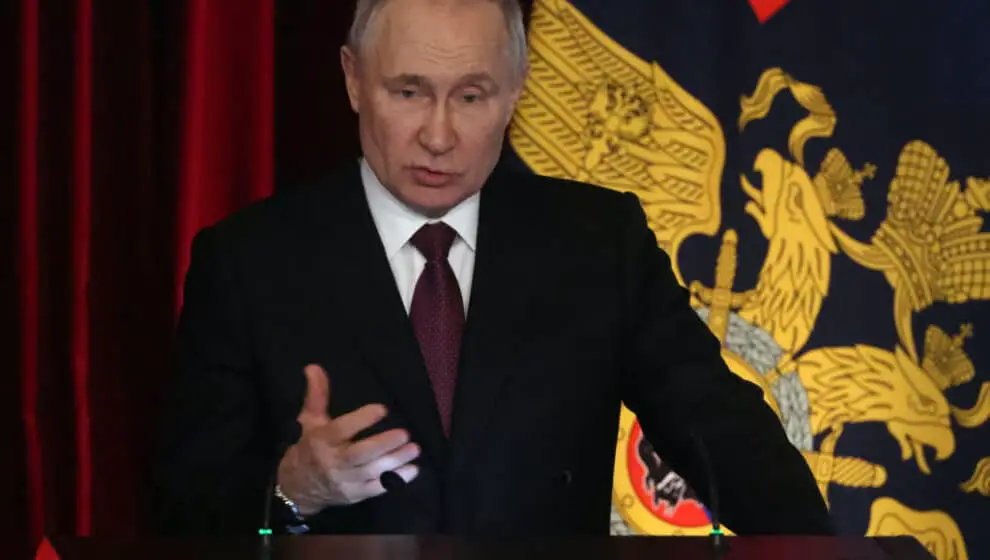

As Russia’s war continues longer than President Vladimir Putin had anticipated, the expenses will likely rise. Without revenue, the Russian government must look elsewhere for investors and aid. This may push the country further into a reliance on China.

An over-dependence on the more dominant Asian country could result in Russia becoming an economic colony of China, something Russian leaders have hoped to avoid.

In part, the worsening conditions in Russia came after Russian President Vladimir Putin limited energy supplies sent to Europe. In theory, the shortages could have weakened western support for Ukraine. Instead, European countries found alternative energy sources. Now, Russia is planning to reduce its oil production. It is already selling its products at a discount rate compared to global energy prices, The Wall Street Journal reports.

Compared to last year, Russia’s energy revenue has been cut in half during the first two months of this year. The government is now reaching into its sovereign-wealth fund—a safeguard the country keeps in case of crisis.

The fund still has a significant $147 billion, and the country still has access to domestic loans. Additionally, Russia still sells its energy supplies to China and India. China has also helped the country by supplying the parts it once purchased from Western countries.

Russia’s more recent global actions have undoubtedly affected the nation’s growth. Before Russia’s invasion of Crimea, the International Monetary Fund estimated that Russia’s potential growth rate was around 3.5%. Now, that number is closer to 1%—true signs of a sluggish economy.

These factors, combined with growing government spending, a tight labor market, and reduced exports, mean Russia’s inflation rate could get worse. In February, the Russian inflation rate was around 11%. That number is expected to temporarily improve in the next few months, The Wall Street Journal reports.