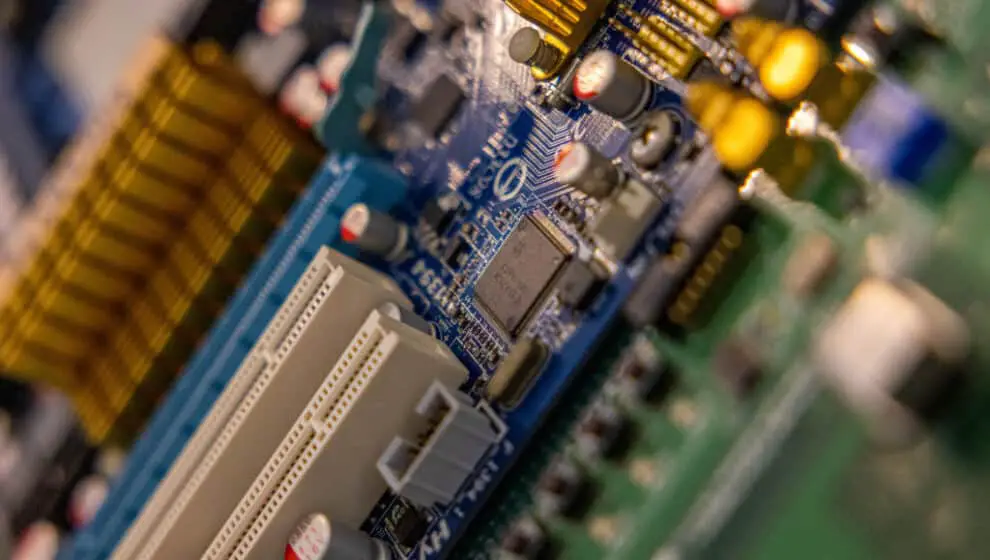

TSMC, the world’s largest chip manufacturer, is considering Arizona as its location for a new manufacturing facility.

Key Details

- Taiwan Semiconductor Manufacturing Co. (TSMC) is looking for a location for a new multibillion-dollar factory and its eyes are reportedly set on Arizona, The Wall Street Journal reports.

- The company has already committed to another chip factory just north of Phoenix. The new facility is expected to be nearby.

- Total investment is expected to be similar to the other facility which cost around $12 billion.

Why it’s news

TSMC’s interest in American expansion is likely related to U.S. export regulations on semiconductor chips and incentives making it more attractive for companies to manufacture chips in the U.S.

This new facility would be responsible for manufacturing 3-nanometer transistors. These miniscule chips would be the smallest and fastest processors currently available.

Whether or not TSMC will set up this manufacturing facility in Arizona isn’t officially decided, however. Currently, the company is working on a new building that will function as a second fabrication site for its current facility in Arizona. While the company is considering making this the site of more advanced manufacturing, no official decision has been made.

Backing up a bit

News of TSMC looking to expand may be somewhat surprising in the face of declining demand for semiconductor chips. However, the plans show that TSMC is not overly concerned about the market bouncing back.

TSMC is cutting back on spending plans and other costs, but potential future plans indicate that the company doesn’t think spending cuts will be needed long term.

The chip-making giant isn’t just looking to expand in the U.S.—it also has expansion plans in Japan and Singapore.

By December, TSMC plans to host a ceremony in Arizona while installing the first bit of production equipment in the plant currently being built. When completed, this plant will produce the 5-nanometer chips. Production is expected to start in 2024.