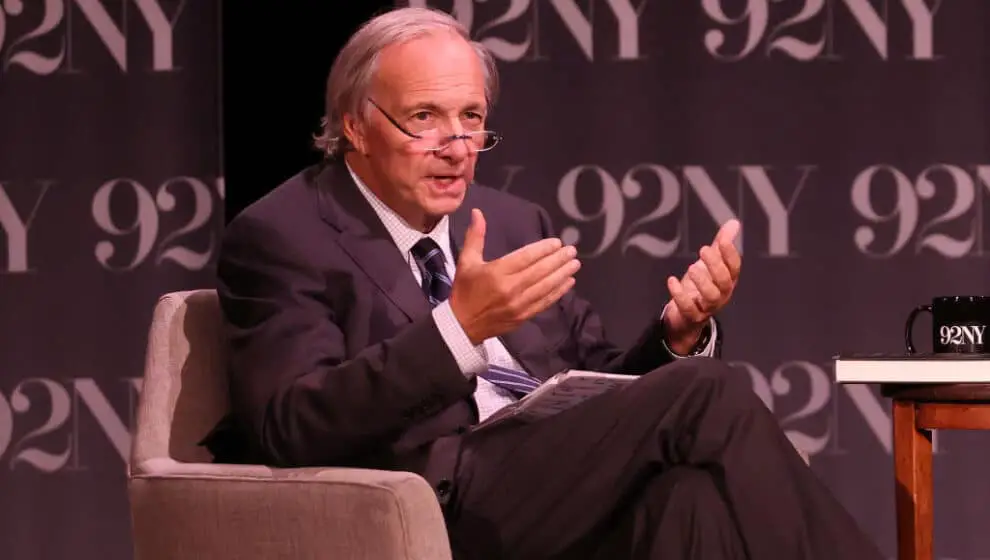

Ray Dalio’s latest book discusses how debt crises arise and provides insight on how to properly navigate one.

Key Details

- In his book Principles for Navigating Big Debt Crises, Dalio shares his belief that many events tend to repeat themselves and can therefore be studied and learned from.

- The book is divided into three parts beginning with the debt cycle, examples of debt crises, and finally an overview of the worst debt crises spanning 100 years.

- By helping readers analyze history, Dalio teaches how to watch for a looming debt crisis and how to navigate one when it comes.

Why it’s important

Dalio’s insight into navigating a debt crisis is especially insightful as he was one of the few individuals who did so successfully in the past. Through his firm Bridgewater Associates, Dalio anticipated the 2008 financial crisis and helped his firm survive it.

The template that Dalio describes in his book is one of the tools he credits with helping his firm survive a debt crisis.

Even a casual reader can find helpful information for a better understanding of the world of debt and prepare themselves for any financial crisis in the future.

Dalio’s firm Bridgewater is one of the world’s largest and best-performing hedge funds. As a successful investor, Dalio has been on the Time list of the 100 most influential people in the world and Bloomberg Market’s list of 50 most influential people.

Already, Daio has multiple successful books including, Principles, Principles For Navigating Big Debt Crises, and Principles For Dealing With the Changing World Order.