In the 90s and early 2000s, if you needed a DVD player or a new television, you had two options: Circuit City or Best Buy. The electronics retail stores were in the middle of an intense competition for customers. Both were riding high on success, but fortunes would soon change. Today, everyone can likely tell you where the nearest Best Buy is, while Circuit City (though technically still around) is all but history.

So what happened? After all, Jim Collins in Good to Great touted Circuit City as one of his eleven “great” companies set up for a long future of sustained success. As it turns out, both Circuit City and Best Buy ran into similar problems. For a while, it looked like Best Buy would suffer the same fate as its competitor. The only difference was that company leaders were able to keep the business from crashing.

But what did Best Buy do right? The key was changing the company’s mindset from finite to infinite—a belief that the world didn’t have to be boiled down to only winners and losers. This new mindset, along with a focus on key strengths and a better experience for customers and employees, turned Best Buy’s fortunes around. Their comeback teaches business owners worldwide how to avoid losing big, and what to fix if you feel like it’s already too late.

Best Buy History

The Best Buy background begins in 1966 with Richard M. Schulze. He, along with a partner, opened up a music store called Sound of Music in St. Paul, Minnesota. Over the next decades, Schulze grew the store and renamed it Best Buy Company, Inc. in 1983. In an interesting twist, Schulze attempted to sell his company to Circuit City in 1988, offering up the business’s position in Minnesota as advantageous for the larger organization. Circuit City, however, rejected the offer. Undeterred, Schulze refocused on his stores and came up with an impressive change to them he called “Concept II.”

On Best Buy’s 50th Anniversary, Schulze talked about this strategy.

“About five years later, we introduced our ‘Concept II’ store into the marketplace, which was really the seminal decision to put the customer in control of the process . . . That was the springboard. There was no turning back at that point. We couldn’t open these stores fast enough.”

It’s important to note that electronics stores at the time were almost like large warehouses—plenty to offer but not the most aesthetically pleasing. Schulze aimed to change that. Through Concept II, Best Buy’s stores would feature bright lighting and fewer pushy salespeople. All available products were within reach and not locked away in a storeroom, and salespeople didn’t work on commission. It was a consumer-friendly approach that paid off. By 1992, the company experienced a billion dollars in revenue for the first time.

More growth would happen over the 1990s, leading Best Buy to branch out even further. The company formed Redline Entertainment in 2000 as an independent music label. Best Buy also made several big acquisitions, most notably Geek Squad in 2002. The business was positioning itself to be competitive as it kicked off a new decade.

The Retail Apocalypse Arrives

Best Buy’s fortunes started to falter thanks to one word: Amazon. The 2000s saw Amazon steadily grow in popularity. Before long, they became a direct competitor to Best Buy and all other retail outlets, offering similar products at much lower prices.

The so-called “Retail Apocalypse” had begun, leading to the demise of many stores such as Sports Authority, Payless Shoe Source, Toys “R” Us, and Circuit City. Best Buy ran into these problems as well. A common pattern would be for customers to come into a Best Buy to check out the products first-hand, then return home and simply buy them for a lower price online. As a result, the company posted its first decline in 2012. A year later, the business lost more than $7 billion in revenue.

Mismanagement at the Highest Levels

If the hit to revenue wasn’t devastating enough for Best Buy, further problems in management would add to the disaster. In 2012, the company investigated possible misconduct by CEO Brian Dunn. Dunn, who CNBC would name as one of the worst CEOs of 2012, was accused of having an inappropriate relationship with a female employee. Dunn would resign in the middle of the investigation. The resignation was a terrible blow for the company. Brian Dunn had been with Best Buy for decades, starting out as a salesman in 1985. He seemed like the perfect choice to lead the business, but his actions led to his downfall.

The scandal extended beyond the CEO. As the internal investigation eventually found, Richard Schulze, who was then acting as chairman, had known about the relationship and kept quiet. As a result, he was forced to resign, ousting the founder of the company.

Best Buy Hits Rock Bottom

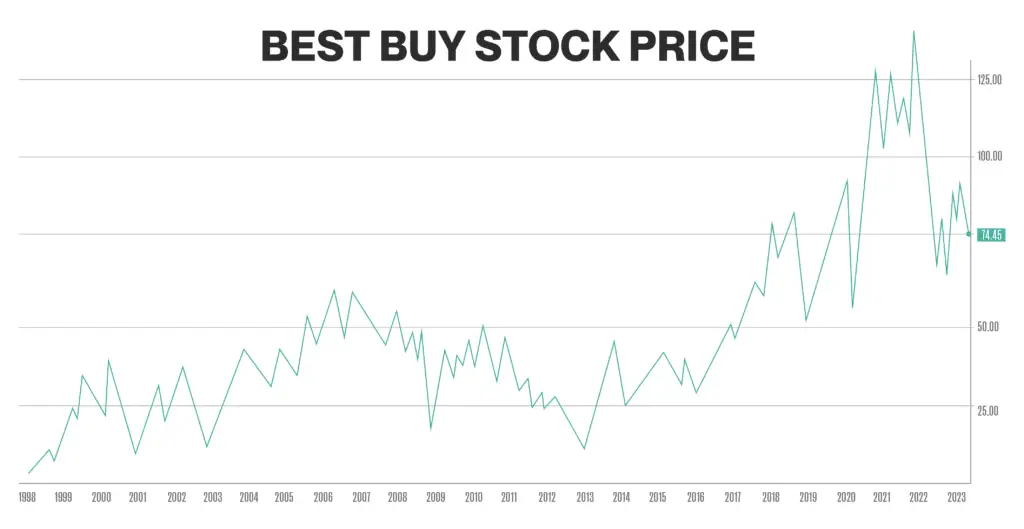

2012 can easily be described as the worst year in Best Buy history. The company’s stock plunged to only $12 per share, down from a high of $56 per share in 2006. More disastrous was the fact the company lost an astounding $1.7 billion in one quarter alone. Best Buy was hemorrhaging customers and money, and it looked like the end was just around the corner.

Adding to the bad news was the fact that Schulze didn’t want to fade into the background. Even though he resigned as chairman, Schulze still owned 20 percent of the company and wanted to take control of Best Buy again. This would mean buying out the company with a majority stake. To do so, he would need to raise billions of dollars. So, he created a plan called Blue Bird with other investors to gather the funding necessary to do so.

Best Buy had a full-blown crisis on its hands. Sales were shrinking and internal conflict had exploded into headlines. Something had to change quickly.

A New CEO Takes the Reins

“Hubert’s range and depth of experience in transforming companies is exactly what the company needs at the moment.”

Hatim Tyabji

Under Brian Dunn, Best Buy’s stock had fallen 80 percent. The hope was that a new CEO could turn things around. That enormous task fell upon Hubert Joly. Before coming to Best Buy, Joly worked as the president and CEO of Carlson Companies, which mainly dealt with travel, hotels, and restaurants. Under his leadership there, Carlson sustained impressive growth. With an uncertain future on the horizon, the board of Best Buy wanted him to apply this type of transformational leadership to their company.

Joly came right out of the gates with a bold move. Instead of seeing customers flee to Amazon due to their low prices, Best Buy would compete. In fact, they would match the price that Amazon offered. Joly saw this as a necessary move if Best Buy wanted to survive. As he explained, “Until I match Amazon’s prices, the customers are ours to lose.”

This was the fighting spirit the company desperately needed.

Working With the Competition

“You won’t get me to say a bad word about Amazon. It’s not a zero-sum game.”

Hubert Joly

Hubert Joly also made a strategic decision that few would have considered at the time. While he was competing with Amazon by price matching, he would also work with them. Joly made partnerships with many of Best Buy’s competitors. In addition to Amazon, the business partnered with Samsung, Apple, and Microsoft, allowing them to set up boutiques in Best Buy’s stores. These companies would pay Best Buy rent for using their floor space while showing off their products.

This move made sense for competitors since it allowed them to have prime real estate for a fraction of the cost of running their own stores. For Best Buy, it meant another source of revenue while providing other reasons for customers to stop in.

Joly didn’t view other companies as competitors. Instead, he saw them as potential partners. In this, he demonstrated an infinite game mindset, where there didn’t have to be “winners” and “losers.” When he reflected after five years on the job, he stated, “I don’t believe this is a winner-takes-all market.”

Joly embraced these changes, seeing them as necessary to ensure Best Buy’s survival. Stagnation would be catastrophic for the company. Instead, they had to evolve and stay on the cutting edge. “If you try to direct a bicycle at standstill, you fall,” he said. “The key is to get moving.”

Focusing on Employees

Another challenge Joly faced was the low employee retention Best Buy had. He addressed this first by going directly to individual Best Buy stores to get feedback from the employees directly. He even worked at a store for a week to get a small taste of what it was like to work there. From these interactions, he knew what he had to do.

Joly’s predecessor had gotten rid of a generous discount program that employees had enjoyed. As one of his first actions, he brought back the program, giving added perks to being a Best Buy employee. He also saw the value in training employees to be experts in technology. As a result, he leaned into the Geek Squad acquisition from years before and trained Best Buy employees to be the consummate tech pro—knowledgeable in everything the customer might want to know. Through these policies and effective people management, the turnover rate at Best Buy fell from 55 percent down to 30 percent.

Joly saw Best Buy employees as one of the attributes that set the company apart from competitors. He embraced what made Best Buy great in the first place. That included the fact that they had physical stores. When Best Buy looked to be in a death spiral, it would have been easy for the company to try to become something it wasn’t. Joly didn’t see it that way, though. While much of the world turned to online shopping, Joly could see the advantages Best Buy had by having a physical store. Instead of shying away from it, he leaned into it, emphasizing the face-to-face interaction customers could have with experts.

The new CEO certainly didn’t take employees for granted. Joly could see that they provided eyes on the ground level for how the company could improve. He reached out to employees, seeking direct feedback on what should change. This made sure he was addressing real issues.

A New Chapter for Best Buy

The changes Joly enacted got immediate results. Over the course of five years, the company’s market share grew to 15 percent and the share price rose 271 percent. Today, it stands at $78 per share, a significant increase from its low point of $12 per share.

Best Buy hasn’t been immune from the struggles many retailers have faced in the wake of the pandemic. That makes their comeback from 2012 all the more important. Had the company’s leadership not sorted things out during that time, it’s very possible the company would have gone under during this difficult period.

Best Buy largely has Hubert Joly to thank for that. In stark contrast to his predecessor, Joly was named as one of the “Best-Performing CEOs in the World” by Harvard Business Review in 2018. By the time he stepped down as CEO in 2019, he had helped turn things around for the consumer electronics company. Joly always maintained optimism for Best Buy’s future. “The destination is exciting,” he said, “but I think the journey is going to be even more exciting because we have this opportunity to work together to build an amazing future that does not yet exist.”

Learn more about business strategy from the following articles:

What Innovation Strategy Looks Like in Practice