In America, being healthy is a major priority. If you aren’t on a diet plan, have a fitness app, take supplements, or have a gym membership, you likely know someone who is. For example, there are currently 112,676 gyms and fitness clubs in the United States, over 100 different kinds of diet plans, and an estimated 86.3 million users of health and fitness apps. By 2024, the supplement industry is expected to grow to $56.7 billion.

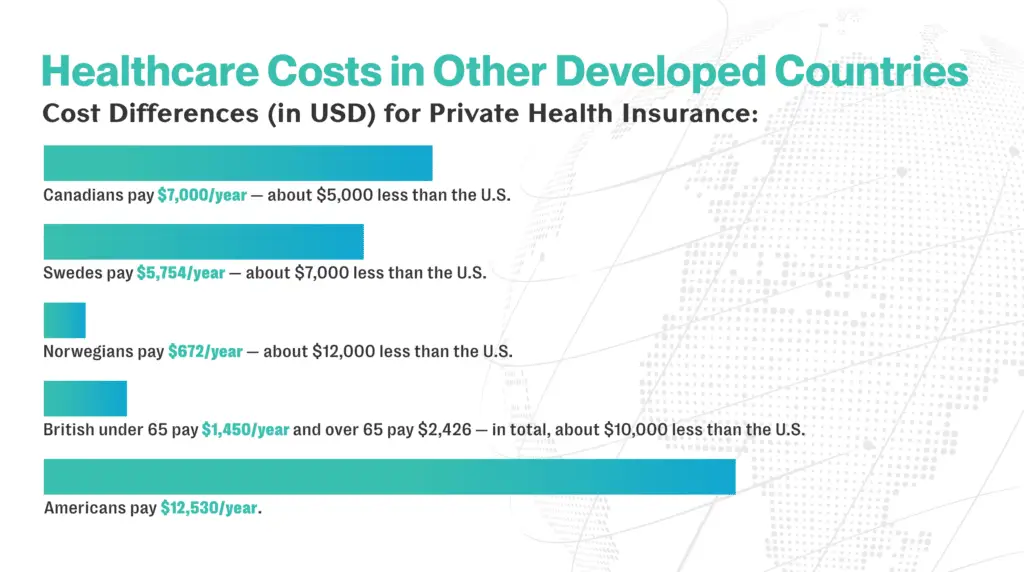

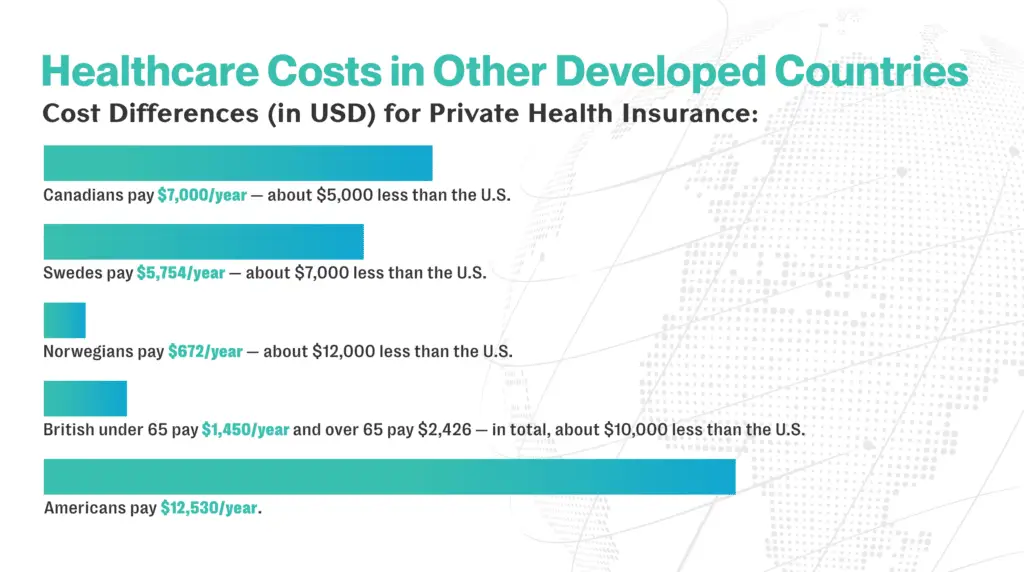

Despite our nation’s obsession with being healthy, medical costs for health care consume a significant portion of the average American’s wages. According to Zippia, the average personal income in the U.S. is $63,214, but the average health care spending per capita is $12,530. A quick calculation reveals that this means personal health care costs come to about 20% of the average annual salary—more than anywhere else in the world.

This insight raises interesting questions. Why does the U.S. emphasize good health, but health care costs more than in-state college tuition? Why are some Americans going bankrupt from paying medical bills?

Key Takeaways

- U.S. health care costs are the highest of any other developed country.

- High provider fees and premiums primarily result from a lack of pricing regulation.

- Administrative “waste” and time-consuming regulations also drive high health care costs.

- The answer to health care woes may be a political one, but hope for improvement exists.

How Health Insurance in the U.S. Works

Navigating the health care system in the U.S. can be tricky. Essentially, it starts with having either public or private health insurance coverage. Each type has wildly different fees, requirements, policies, and out-of-pocket expenses. If you have no insurance, then all fees for care come directly to you.

Public health insurance is government-run and includes programs like Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP) for individuals and families that qualify. There are often no copays or deductibles for public health insurance but provider options are limited and the quality of care can be low.

Private health insurance is the insurance many employees receive from their employers. Unlike public health insurance, private plans include monthly premiums that some employers offer to contribute to as a benefit, but most carriers still pay some portion of it out-of-pocket.

Insurers can elect to either pay a:

- Higher upfront monthly premium, and reduced access care costs when used (like copays).

- Lower monthly premium, and pay more in access care costs when used.

Having health insurance can help patients access care more easily when they need it and with lower (or no) out-of-pocket costs. A visit to the ER, for example, without insurance might cost you $1,220, and a bit less with insurance at $1,082, according to K Health. Or a visit to the doctor without insurance might send you a bill for up to $350, according to Dr. Rob Rohatsch, or maybe just a $25 out-of-pocket copay with it.

This may sound pretty straightforward, but there are still a couple of problems. First, for a country that prioritizes health, a lot of Americans don’t have health care coverage. A 2022 CDC Report revealed that 31.6 million people didn’t have health insurance in 2020. The high cost of health care coverage is the primary reason cited by those lacking coverage.

Second, of those who are insured (and can therefore presumably afford it), about 6% owe more than $1,000, and 1% (three million people) owe more than $10,000 in medical debt, according to a 2022 report by Peterson-KFF. The report explains that “high deductibles and other forms of cost-sharing can contribute to individuals receiving medical bills that they are unable to pay, despite being insured.”

This is the case because the American health care system is overly complicated.

Summary

Other developed countries typically offer insurance with one set, regular fee. The U.S., however, has several additional fees that contribute to the unobtainable high costs for Americans to either have or use their health insurance coverage.

Additional Insurance Fees Explained

- Deductible: This is the amount you pay before your insurance provider begins contributing to the costs. For example, if your plan has a $2,500 deductible, you will have to pay $2,500 out-of-pocket before your insurance will cover their share. This is in addition to your monthly premium costs.

- Copay: Each time you visit a provider using private health insurance, there is usually a copay. This is a fixed amount that patients pay upfront out-of-pocket at the time of the service.

- Coinsurance: Even though you may have health insurance, you’re still expected to pay a percentage of your medical care beyond your deductible and copay. The percentage is called your coinsurance. For example, your coinsurance rate might be 20%. If you go to the ER and it’s $1,000, you’ll be expected to pay $200 in coinsurance, plus your deductible if you haven’t yet met that threshold.

- In-network/out-of-network: Each health insurance company has different contracts with different providers. Providers that are contracted with your insurance are considered in-network, and will therefore work with your coverage. If you see a provider not covered by your insurance, however, they are considered out-of-network and your plan will not cover any of the costs.

- Out-of-pocket maximum: This is the total sum of what you’re expected to pay in deductible payments, coinsurance, copays, and other out-of-pocket costs in a year. Once you’ve reached this amount, your health insurance will cover all costs for the remainder of the year in full. Most people do not reach their out-of-pocket maximum.

Why Is Health Care So Expensive in America?

1. Complicated Systems Causing Costly Administrative “Waste”

Administrative spending is a result of complicated medical systems. When a patient receives care, that data and billing information must pass through multiple channels and levels for review. Multiple channels can create gaps in communication and sometimes work burnout, resulting in errors, missed details, and more administrative work. This is important because the more time and money providers spend on administration, the more they must charge the patient.

The New England Journal of Medicine reported that in 1999, 31% of health care expenditures in the U.S. went towards administration costs. In 2017, that percentage rose to 34.2%, according to a report by Emergency Medicine News. While that percentage has since dropped to 25% in 2019, according to McKinsey and Company, it’s still high. In response, McKinsey experts propose “not to reduce administrative spending to zero but rather to gain the highest value for each administrative dollar spent without sacrificing quality or access.”

2. Unregulated Provider Costs

Blue Cross Blue Shield reported that 90% of consumer health care spending goes toward the high, unregulated prices that providers set for their services. But why are providers charging so much? It starts with the fee schedules that different insurance companies set for different services.

The insurance fee schedule determines the maximum amount they are willing to pay out for a patient’s service. For a doctor working with several insurance companies, meeting all fee schedules and still making money can be a nightmare. Since there is no regulation of provider fees, they often charge the highest fee the environment can sustain, according to Capture Medical Billing. This helps them satisfy all the different fee schedules while maximizing profit. Unfortunately, it means high costs to the patient.

3. Costly and Time-Consuming Federal Regulations

In 2017, the American Hospital Association teamed up with Manatt Health to conduct a review on the impact that the federal regulatory burden had on overall health care costs. Their findings, released in a 2017 Regulatory Overload Report, were critical to understanding the rising costs of health care. Their comprehensive review discovered that $39 billion are spent by health systems each year on fulfilling regulatory requirements alone.

Hospitals and health systems spend so much money on regulation because there are 629 federally mandated regulatory requirements providers must abide by. In fact, the report states that it takes about 59 full-time doctors and nurses per hospital to comply with all the federal regulations. That’s more than 25% of full-time employees in most hospitals who could be helping patients.

The more regulations there are, the more time and resources it costs to satisfy them. Each time a patient is admitted, the hospital pays $1,200 to cover the cost of satisfying the federal regulations for their service.

4. Rising Costs, Decreasing Salaries

While health care costs are increasing, average U.S. salaries are decreasing. The average U.S. salary for 2019 was $69,560. In 2020, it was down 2.9%, to $67,521, according to the U.S. Census. Today, the average salary is even lower, reportedly at $63,214. Health care costs, however, hovered around $10,866 in 2019 before increasing 10% in 2020 to $11,945. The costs for health care in the U.S. have once again increased from 2020, by 9.7%, and are now $12,530 per person. There are many factors contributing to these rising costs, but if average salaries continue to decrease, the gap will widen and the impact will strengthen.

5. “Defensive Medicine” in Fear of Medical Lawsuits

Medical malpractice lawsuits can be devastating for a physician and hospital. Negative publicity damages the reputation of both, and the loss of staff and financial ramifications can have long-lasting psychological effects. Therefore, to avoid potential lawsuits or errors at all costs, physicians will order costly, extra testing—on the patient’s dime. A 2018 paper by the National Bureau of Economic Research defined this practice as “defensive medicine.”

A 2016 study by Johns Hopkins revealed that medical errors are the third leading cause of preventable death. It is estimated that more than 250,000 deaths occur each year due to medical error alone. Of course, not every patient who experiences a medical error dies. According to Healthcare Finance, more than 40% of physicians received a malpractice lawsuit from a surviving patient last year.

Health Care in Other Developed Countries

Canada

Summary: In Canada, all residents are automatically entitled to Canadian Medicare, which provides free access to necessary hospital and physician services. Canadian Medicare is publicly funded through taxes in the 13 provinces and territories. While it is free to residents, many Canadians choose to also carry private insurance.

How much they pay: Canadians pay about $7,000 USD for private health insurance as of 2019, according to the Ross University School of Medicine.

Downsides: Higher Canadian earners must pay more in taxes for their basic coverage. Also, plans and benefits of Canadian Medicare coverage, while free everywhere, can vary in options and accessibility by province.

How they compare to the U.S.: Canadians pay for health insurance coverage through their taxes. In the U.S., only qualified citizens receive access to free, basic health care coverage. Canadian residents pay about $5,000 less than U.S. private health insurance carriers.

Sweden

Summary: Like Canada, Swedish residents are automatically enrolled in and entitled to their country’s universal health care coverage. This coverage supports basic health needs, from inpatient and outpatient services to dental, mental health, and even prescription drugs. Funding for this program comes from regional and municipal-level taxes, according to The Commonwealth Fund. However, 13% of Swedes voluntarily opt to enroll in additional private health insurance to supplement this basic coverage.

How much they pay: Swedish residents pay the out-of-pocket provider fees and copayment rates, which are set by region, for services administered under their basic coverage. For private health insurance, Swedes pay the equivalent of about $435 annually per person, according to the Borgen Project, and about $5,754 annually for all health services in total.

Downsides: Due to a limited number of physicians, Swedish residents have battled long waiting lists to see a provider. To mitigate this, the country has implemented the “0-30-90-90 rule,” guaranteeing that no resident’s wait will exceed 90 days.

How they compare to the U.S.: Swedish residents pay for their health care through taxes, not through premiums and deductibles. But, even with out-of-pocket expenses from basic coverage and from private health insurance, Swedes still pay about $7,000 less than the U.S., as detailed in a Health System Tracker.

Norway

Summary: Norway is another country that offers universal health coverage to all its citizens automatically, regardless of income. The Commonwealth Fund reports that coverage is provided for primary, ambulatory, hospital care, mental health, and some outpatient prescription drugs. Residents are required to pay out-of-pocket copayments, but the National Insurance Scheme places caps on the amount providers can charge.

How much they pay: Norwegian residents pay out-of-pocket for fees covered by basic health care, and 10% of residents have elected to also carry private insurance. Those with private insurance pay the equivalent of about $56 per month, and 91% of this is covered by their employer, according to The Borgen Project.

Downsides: Since health care in Norway is funded through national and municipal taxes, there is no way of “opting out” in order to maximize income. Additionally, there are sometimes significant wait times for service, and residents may only switch physicians twice within a year.

How they compare to the U.S.: Despite an annual deductible of the equivalent of $222 USD that Norwegians must pay each year, the total costs for health care are still about $12,000 less than the U.S.

The U.K.

Summary: Through the National Health Service, all British residents are automatically enrolled in free public health care, according to a report by The Commonwealth Fund. This care includes hospital, physician, and mental health care, and is primarily funded through taxes. However, to gain more rapid access to care, about 10.3% of U.K. residents purchased private health insurance coverage to supplement as of 2019, according to Statista.

How much they pay: Private health insurance carriers under 65 pay the equivalent of about $1,450 each year. Residents over 65 pay closer to $2,425, according to 2021 data from Healthplan.

Downsides: U.K. residents may get health care coverage as a birthright, but they pay more in taxes for it. The Health Foundation reveals that 33% of the U.K.’s 2019 GDP went to taxes—almost 10% higher than the U.S. By 2025–2026, this figure could increase to 35%, according to TaxLab.

How they compare to the U.S.: As of 2020, the total health expenditures for U.K. residents equaled more than $10,000 less than the U.S.

Summary

Unlike Sweden, the U.K., Canada, and Norway, the U.S. government does not facilitate basic, universal health care coverage for all residents. Here, residents must either qualify for public health insurance due to low income or opt-in for private insurance.

The Government’s Role in American Health Care

This difference in national healthcare coverage leads people to wonder what the U.S. government provides, besides Medicare, Medicaid, and CHIP, in exchange for our $11,945 per capita healthcare bills.

Some things the Government is responsible for:

- Setting medical legislation

- Administering the Medicare program and co-funding CHIP

- Overseeing marketplaces for private health insurance providers

- Regulating pharmaceuticals and medical devices

Some things the government is not responsible for:

- Supplying insurance providers, except for the Veterans Health Administration and Indian Health Service

- Regulating service costs set by providers

- Regulating costs for new technologies and prescription drugs

- Enforcing provider and insurance company price transparency

Are High Health Care Costs a Political Matter?

The Affordable Care Act (ACA, also known as “Obamacare”), enacted in March of 2010, was set into motion by former President Barack Obama. Despite the political controversy, the act served to extend public insurance coverage to millions of Americans with pre-existing conditions who would not have formerly qualified, as detailed in a report by Genesis Health. The passing of the Affordable Care Act was significant because it represented one of the first and largest federal movements, despite politics, toward health care reform.

The role that the federal government should play in health care is a topic of political debate. The Pew Research Center revealed that about 85% of Democrats believe it is the government’s responsibility to ensure there is quality health care coverage for all; 68% of Republicans, however, believe it is not. Therefore, the future of health care reform is largely dependent on who is in office.

For now, President Biden has stated that he “has a plan to build on the Affordable Care Act by giving Americans more choice, reducing health care costs, and making our health care system less complex to navigate.”

What Needs to Happen to Reduce Costs

Research by the Kaiser Family Foundation outlines three approaches policymakers can take in an effort to push down pricing: price regulation, global budgets, and spending growth targets.

Explanation of the Strategies:

Price regulation: This would set direct caps on the price of certain services and how much those prices could grow.

Global budgets: By enacting a limit, the responsibility of determining how to keep health care spending under budget would fall onto the providers and payers themselves.

Spending growth targets: This would limit how much spending could grow within a specified time period. This approach would require providers to throttle their own volume and pricing accordingly to be sure not to exceed that limit.

Of course, the different complicated factors and systems can still make the concept of reducing health care costs seem daunting. The passing of the Affordable Care Act, however, and other encouraging political shifts demonstrates the initiation of change, and the hope for continued improvement.

Summary

Only by increasing transparency, using price shopping tools, and fostering provider competition, can the costs of health care in the U.S. begin to drop.

What You Can Do to Reduce Costs

The whole health insurance system can feel entirely outside of your control. After all, there isn’t much we, personally, can do to mitigate high provider fees and reduce out-of-pocket costs. Or is there?

According to the CDC, clinical preventive care is substantially underutilized in the U.S., yet it’s critically important in protecting our health and wallets. When preventative habits are part of a regular routine, the need to visit a provider for an emergency is greatly reduced. Here are some things you can do each day that will boost your immune system, reduce your risk for disease, and ensure you’re feeling your best:

- Get at least 30 minutes of moderately intense exercise each day.

- Shoot for at least seven hours of sleep each night.

- Drink 11–15 cups of water each day.

- Eat a diet rich in vegetables, fruits, fiber, healthy fats, and lean protein.

- Incorporate supplements.

- Attend regular, yearly screenings and exams.

Want to put some of those out-of-pocket costs back into your pocket? Continue by reading “25 Ways to Make Extra Money.”

Leaders Media has established sourcing guidelines and relies on relevant, and credible sources for the data, facts, and expert insights and analysis we reference. You can learn more about our mission, ethics, and how we cite sources in our editorial policy.

- IBISWorld – Industry Market Research, Reports, and Statistics. (n.d.). Retrieved September 8, 2022, from https://www.ibisworld.com/industry-statistics/number-of-businesses/gym-health-fitness-clubs-united-states/

- Henderson, N. (2022, August 25). 100 Different Diet Plans That Could Help You Lose Weight — We’ve Got Tons of Info to Help You Decide. Parade: Entertainment, Recipes, Health, Life, Holidays. Retrieved September 8, 2022, from https://parade.com/986848/nancy-henderson/types-of-diets/

- Statista. (2021, July 6). U.S. health and fitness app users 2018-2022. Retrieved September 8, 2022, from https://www.statista.com/statistics/1154994/number-us-fitness-health-app-users/

- 25 Fascinating Supplements Industry Statistics [2022] – Zippia. (2022, July 30). Retrieved September 8, 2022, from https://www.zippia.com/advice/supplements-industry-statistics/

- Average American Income [2022]: Statistics On Household + Personal Income In The US – Zippia. (2022, July 25). Retrieved September 8, 2022, from https://www.zippia.com/advice/average-american-income/

- Wilson, K. (2022, February 12). 2022 Edition — Health Care Costs 101. California Health Care Foundation. https://www.chcf.org/publication/2022-edition-health-care-costs-101/

- Song, J. (2021, January 11). Average Cost of College in America. ValuePenguin. Retrieved September 8, 2022, from https://www.valuepenguin.com/student-loans/average-cost-of-college

- deGraft-Johnson, L., MD. (2022, July 21). How Much Does an ER Visit Cost in 2022? With and Without Insurance. K Health. Retrieved September 8, 2022, from https://khealth.com/learn/healthcare/er-visit-cost/

- Barber, M. (2022, March 23). How Much Does a Doctor’s Visit Cost Without Insurance? Solvhealth.com. Retrieved September 8, 2022, from https://www.solvhealth.com/blog/how-much-does-a-doctor-s-visit-cost-without-insurance

- Cha, A. (202 C.E., February 11). Demographic Variation in Health Insurance Coverage: United States, 2020. CDC.org. https://www.cdc.gov/nchs/data/nhsr/nhsr169.pdf

- Key Facts about the Uninsured Population. (2020, November 13). KFF. Retrieved September 8, 2022, from https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/

- The burden of medical debt in the United States. (2022, March 23). Peterson-KFF Health System Tracker. Retrieved September 8, 2022, from https://www.healthsystemtracker.org/brief/the-burden-of-medical-debt-in-the-united-states/

- Woolhandler, S., Campbell, T., & Himmelstein, D. (2003, August 21). Costs of Health Care Administration in the United States and Canada. New England Journal of Medicine. https://www.nejm.org/doi/full/10.1056/nejmsa022033

- Shaw, G. (2022, January). Special Report U.S. Health Care Administrative Costs Skyrocket. Emergency Medicine News. https://journals.lww.com/em-news/Fulltext/2022/01000/Special_Report__U_S__Health_Care_Administrative.6.aspx

- Sahni, N. R., Mishra, P., Carrus, B., & Cutler, D. M. (2022, August 1). Administrative simplification: How to save a quarter-trillion dollars in US healthcare. McKinsey & Company. Retrieved September 8, 2022, from https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/administrative-simplification-how-to-save-a-quarter-trillion-dollars-in-us-healthcare

- Why does healthcare cost so much? (n.d.). Blue Cross Blue Shield. Retrieved September 8, 2022, from https://www.bcbs.com/issues-indepth/why-does-healthcare-cost-so-much

- Why Do Doctor Bills Vary Widely? (n.d.). Retrieved September 8, 2022, from https://capturebilling.com/why-do-doctor-bills-vary-widely/

- Assessing the Regulatory Burden on Health Systems, Hospitals and Post-acute Care Providers. (n.d.). aha.org. Retrieved August 14, 2022, from https://www.aha.org/guidesreports/2017-11-03-regulatory-overload-report

- Regulatory Burden Overwhelming Providers, Diverting Clinicians from Patient Care. (2018, January). aha.org. https://www.aha.org/system/files/2018-01/regulatory-burden-overwhelming-providers-infographic.pdf

- US Census Bureau. (2022, June 9). Income and Poverty in the United States: 2020. Census.gov. Retrieved September 8, 2022, from https://www.census.gov/library/publications/2021/demo/p60-273.html

- Average American Income [2022]: Statistics On Household + Personal Income In The US – Zippia. (2022b, July 25). Retrieved September 8, 2022, from https://www.zippia.com/advice/average-american-income/

- Study Suggests Medical Errors Now Third Leading Cause of Death in the U.S. – 05/03/2016. (n.d.). Retrieved September 8, 2022, from https://www.hopkinsmedicine.org/news/media/releases/study_suggests_medical_errors_now_third_leading_cause_of_death_in_the_us

- Norway. (n.d.). Commonwealth Fund. Retrieved September 8, 2022, from https://www.commonwealthfund.org/international-health-policy-center/countries/norway

- Philipp, J. (2020, July 23). 10 Facts About Healthcare in Sweden. The Borgen Project. Retrieved September 8, 2022, from https://borgenproject.org/10-facts-about-healthcare-in-sweden/

- How does health spending in the U.S. compare to other countries? (2022, February 14). Peterson-KFF Health System Tracker. Retrieved September 8, 2022, from https://www.healthsystemtracker.org/chart-collection/health-spending-u-s-compare-countries-2/

- Philipp, J. (2020b, July 27). 8 Facts about Healthcare in Norway. The Borgen Project. Retrieved September 8, 2022, from https://borgenproject.org/facts-about-healthcare-in-norway/

- Guide to Health Insurance and Healthcare System in Norway. (2022, June 9). InterNations. Retrieved September 8, 2022, from https://www.internations.org/norway-expats/guide/healthcare

- England. (n.d.). Commonwealth Fund. Retrieved September 8, 2022, from https://www.commonwealthfund.org/international-health-policy-center/countries/england

- Statista. (2022, August 10). Population covered by public or private health insurance in the UK 2000-2019. Retrieved September 8, 2022, from https://www.statista.com/statistics/683451/population-covered-by-public-or-private-health-insurance-in-united-kingdom/

- Danaev, R. (2021, September 10). How Much Does Private Health Insurance Cost? new.healthplan.co.uk. Retrieved September 8, 2022, from https://healthplan.co.uk/blog/how-much-does-private-health-insurance-cost

- How do UK tax revenues compare internationally? (n.d.). Institute for Fiscal Studies. Retrieved September 8, 2022, from https://ifs.org.uk/taxlab/taxlab-key-questions/how-do-uk-tax-revenues-compare-internationally?tab=tab-372

- The Importance of the Affordable Care Act – Genesis Health System. (n.d.). (C)1998-2022 Geonetric. All Rights Reserved. Retrieved September 8, 2022, from https://www.genesishealth.com/news/2020/the-importance-of-the-affordable-care-act/

- Kiley, J. (2020, August 28). Most continue to say ensuring health care coverage is government’s responsibility. Pew Research Center. Retrieved September 8, 2022, from https://www.pewresearch.org/fact-tank/2018/10/03/most-continue-to-say-ensuring-health-care-coverage-is-governments-responsibility/

- Biden For President. (2020, October 12). Plan to Protect and Build on Obamacare | Joe Biden. Joe Biden for President: Official Campaign Website. Retrieved September 8, 2022, from https://joebiden.com/healthcare/

- Price Regulation, Global Budgets, and Spending Targets: A Road Map to Reduce Health Care Spending, and Improve Affordability. (2022, July 21). KFF. Retrieved September 8, 2022, from https://www.kff.org/health-costs/report/price-regulation-global-budgets-and-spending-targets-a-road-map-to-reduce-health-care-spending-and-improve-affordability/

- Levine, S. (2019). Health Care Industry Insights: Why the Use of Preventive Services Is Still Low. Retrieved September 8, 2022, from https://www.cdc.gov/pcd/issues/2019/18_0625.htm